Raw Materials

Better Cotton launches 2023-24 Annual Report: Impact, expansion and farmer resilience

With a strong commitment to improving the lives and livelihoods of farmers and promoting sustainable farming practices, Better Cotton remains at the forefront of efforts to foster a more equitable and sustainable cotton across the industry.

"Better Cotton is at an exciting juncture, and if there is one key takeaway from 2023, it is the need for us to come together and build on the momentum we’ve created. The proven solutions we’ve developed have taken us far, but continued commitment and investment in cotton farming communities are essential to accelerate the wider impact our world needs", commented Alan McClay, CEO at Better Cotton.

Key Highlights

In the 2022-23 cotton season, 5.47m MT of Better Cotton were produced, representing 22% of global volumes (25.03m MT). This spanned 22 countries around the world in collaboration with close to 60 Programme Partners.

In the 2022-23 cotton season, out of 2.43 million farmers who received training, more than 2.13 million received a licence to sell their cotton as ‘Better Cotton’.

In 2023, Better Cotton welcomed 311 new members, including 37 Retailers and Brands and 264 Suppliers and Manufacturers.

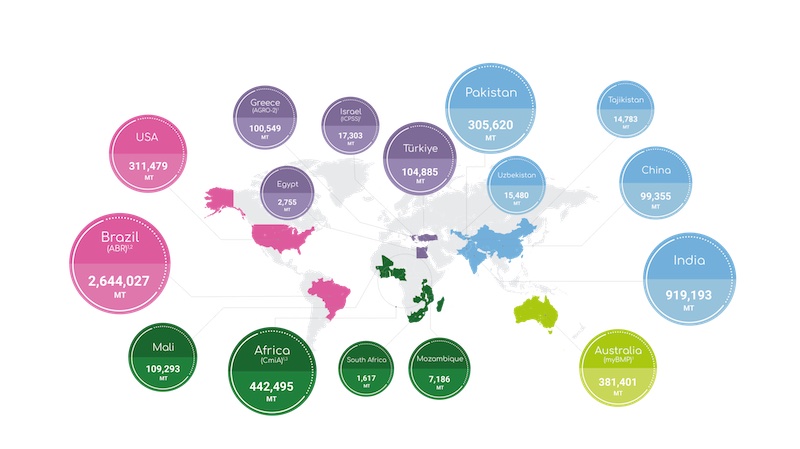

Volume of Better Cotton Grown (2022-23 Season Data)

In Brazil, the largest producer of Better Cotton, the volume of licensed Better Cotton grew from 1.97m MT in the 2021-22 season to more than 2.64m MT in the 2022-23 season.

In India, yields also increased from around 863,000 MT in the 2021-22 season to more than 917,000 MT in the 2022-23 season.

In contrast, Pakistan’s cotton farmers were hit hard by devastating floods which led to a significant drop in the volumes of Better Cotton produced from 817,000 MT in the 2021-22 season to 305,000 the following year.

Production in Africa also decreased from around 630,000 MT to 442,000. This was primarily due to a Jassid pest infestation in Mali that affected up to 50% of the country’s cotton crop.

Elsewhere, the 2022-23 cotton season was one of continued growth for several countries including the USA, Australia, Turkey, Egypt, Israel and Greece.

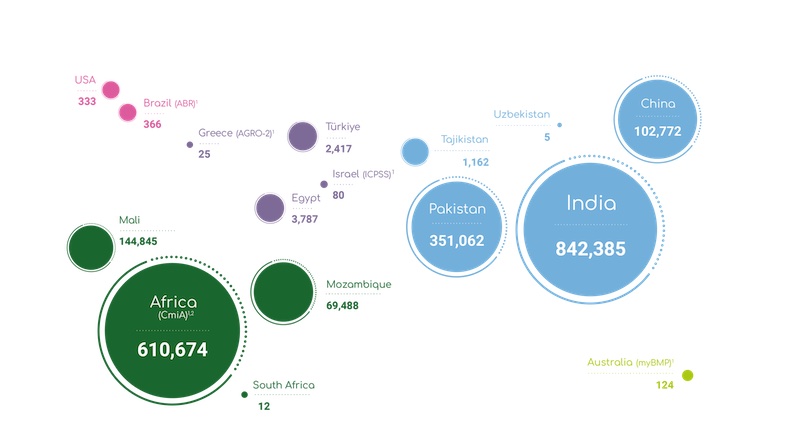

Better Cotton Licensed Farmers Around the World (2022-23 Season Data)

The most notable growth in licensed farmer numbers during the 2022-23 season came across Africa, where the total aligned with Better Cotton and its Strategic Partner, Cotton made in Africa (CmiA) improved from 570,000 in the 2021-22 season to more than 610,000 in the 2022-23 season.

In Pakistan, the number of Better Cotton licensed farmers fell from 510,000 to just over 351,000, again due to the effects of the floods. Modest gains were seen in Turkey, Egypt, Greece and the USA.

Membership and Operational Highlights

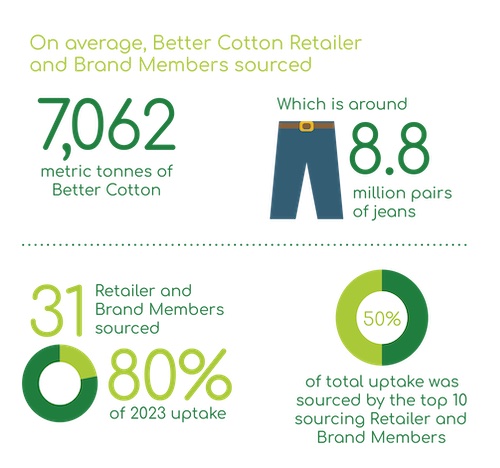

Despite a challenging business landscape, member sourcing was almost on par with 2022 sourcing results: 343 retailers and brands sourced 2.5 million MT of Better Cotton in 2023.?

Throughout 2023, Better Cotton made a number of key announcements, including the launch of Better Cotton Traceability in November. The new solution enables members to trace Better Cotton back to its country of origin.

In 2023, Better Cotton expanded its global reach with new programmes in Spain and Côte d’Ivoire, the latter in partnering with the Professional Association of Cotton Companies of Côte d’Ivoire to support 200,000 farmers over five years.

In addition, the India Impact Report, published in September, revealed significant progress, including a 53% reduction in pesticide use and a 15.6% decrease in overall costs on Better Cotton farms, showcasing the ongoing positive impact of its initiatives across eight cotton seasons.

Outlook to 2023-24

In response to the changing legislative landscape, Better Cotton has been working with members, peer sustainability standards schemes and other relevant stakeholders to evolve our standard requirements and Claims Framework. In 2025, we will publish our Claims Framework v.4.0 to address these new realities.

As part of this, complemented by a robust approach to assurance, we are developing a new label which will enable brands sourcing Physical Better Cotton to market products to consumers as containing Better Cotton for the very first time.

We are also working on evolving our assurance programme to an accredited certification scheme, where all licensing decisions will be carried out by independent, third parties moving forward.

This shift will enable legal compliance and further strengthen the credibility of our assurance activities and the Better Cotton label.

https://bettercotton.org/wp-content/uploads/2024/09/2023-24-Annual-Report.pdf