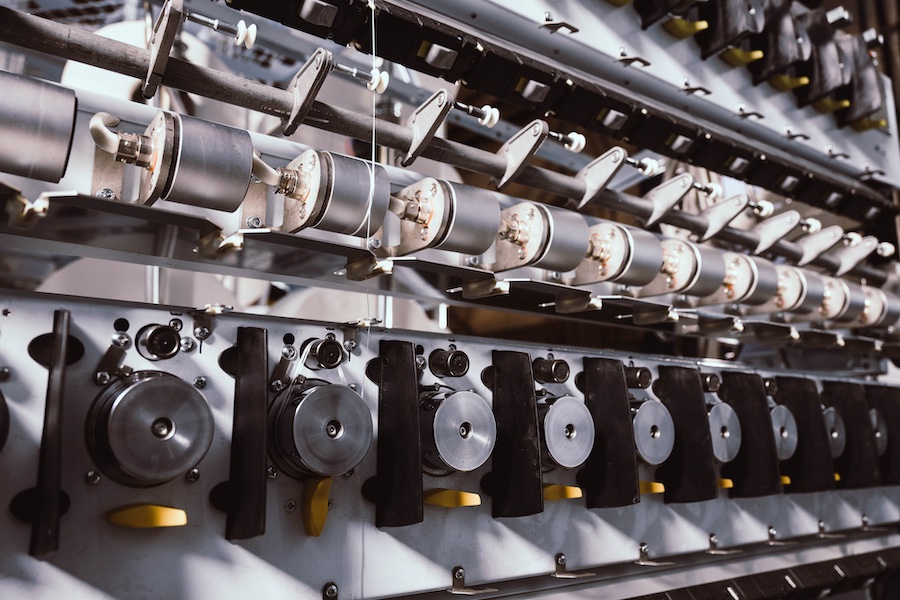

#Spinning

Polymer Processing Solutions is operating under the Barmag brand again

Strengthening of market presence through return to the Barmag brand

With effect from 1 January 2025, the manmade fibre business was established as an independent subsidiary within the group and has since been operating under the traditional name Barmag. The organisational separation from Oerlikon Surface Solutions enables an even stronger focus on the specific needs of the market for manmade fibre solutions.

Michael Suess, Executive Chairman of Oerlikon, stated: “Our pure-play strategy has achieved an important milestone. Effective January 1, 2025, Oerlikon is a leader in surface technologies with its subsidiary for manmade fibers solutions, Barmag. For the final separation, we are making good progress in evaluating various options over the next 12-24 months. Our ultimate goal remains to create maximum value for all stakeholders.”

Generational change in the company’s operational leadership

Oerlikon appoints Dirk Linzmeier, 48, as Chief Operating Officer (COO) and Member of the Executive Committee, effective April 1, 2025. As part of the company’s strategic transition to pure play the newly created COO role will lead the Surface Solutions business operations under the name Oerlikon and will report to Executive Chairman Michael Suess.

Changes to the Board of Directors

As part of its long-term succession planning, the Board of Directors has nominated Dr. Stefan Brupbacher, Marco Musetti and Dr. Eveline Steinberger for election as new members at the upcoming Annual General Meeting on April 1, 2025. They will succeed Irina Matveeva, Gerhard Pegam and Zhenguo Yao who will not stand for re-election. These announced changes to the Board are aligned with Oerlikon’s current strategic transformation into a leader in surface technologies, strongly rooted in Swiss quality and innovation culture.

Important pure-play milestone achieved: Oerlikon is a leader in surface technologies with a subsidiary for manmade fibers solutions

In February 2024, Oerlikon announced the final step in its long-term pure-play strategy, stating that it will focus on high-tech surface solutions and advanced materials moving forward.

Throughout 2024, Oerlikon initiated and progressed the organizational separation of Manmade Fibers (Polymer Processing Solutions excluding HRSflow). As of January 1, 2025, this business operates as a stand-alone subsidiary and will adopt the traditional Barmag name. Georg Stausberg will remain on the Executive Committee and continue to report to Executive Chairman Michael Suess. HRSflow will be reported as part of Surface Solutions, effective January 1, 2025.

As announced in November 2024, Oerlikon began implementing its efficiency plan to combine the Corporate and Surface Solutions Division functions to align costs with the pure-play scope. To ensure business continuity and retain talent, Oerlikon introduced a retention plan. This streamlining will result in an agile and lean organization.

These steps lay the groundwork for Oerlikon to focus exclusively on surface technologies. Oerlikon is on track with evaluating options for the separation of Barmag (Manmade Fibers) over the coming 12-24 months, with the aim of creating value for all stakeholders.

Oerlikon has been transforming from an industrial conglomerate into a surface technologies leader over the last decade. The Group has streamlined from five divisions to its current two, using the proceeds for dividends and to develop both divisions organically and inorganically. Surface Solutions is now a resilient market leader, diversified across technologies, end markets and geographies. Barmag (Manmade Fibers) is the clear filament equipment market leader in terms of innovation and sustainability, showing growth through the cycle and attractive returns.

Oerlikon Group 2024 financial overview

In 2024, the Group’s organic order intake was roughly stable year-over-year at constant FX (-1.8%) despite the difficult environment. Organic sales decreased (-10.1%) at constant FX, driven by Polymer Processing Solutions’ order downturn in 2023.

Operational EBITDA was CHF 393 million (2023: CHF 444 million), or 16.6% of sales (2023: 16.5%). This represents a strong margin in the context of lower sales, supported by efficiency, innovation, and pricing. Oerlikon’s net result was 72 million, an increase of 209.6% compared to last year's level which was impacted by one-off charges.

Dividend of CHF 0.20 per share

The Board will recommend to shareholders an ordinary dividend payout of CHF 0.20 per share at the AGM on April 1, 2025, taking place at ENTRA, Rapperswil-Jona, Switzerland.

2025 outlook

At the Group level, Oerlikon expects organic sales at constant FX to be stable or to increase by a low single-digit percentage. Innovation, pricing and efficiency at Surface Solutions is expected to be offset by a transitorily lower margin at Barmag (Manmade Fibers). As a result, Oerlikon expects ~15.5% operational EBITDA margin for the Group.

Barmag (Manmade Fibers) is expected to have stable or a low single-digit percentage increase in organic sales at constant FX. Order intake is expected to have seen the trough in 2024. Operational EBITDA margin is expected at ~7.5% (2024: 10.3%). This represents a year-over-year decrease as a result of transitory price concessions done in 2024 to maintain order volume. Beyond 2025, Barmag’s (Manmade Fibers) operational EBITDA margin is expected to be positively impacted by a pricing recovery and the ongoing optimization of manufacturing footprint.

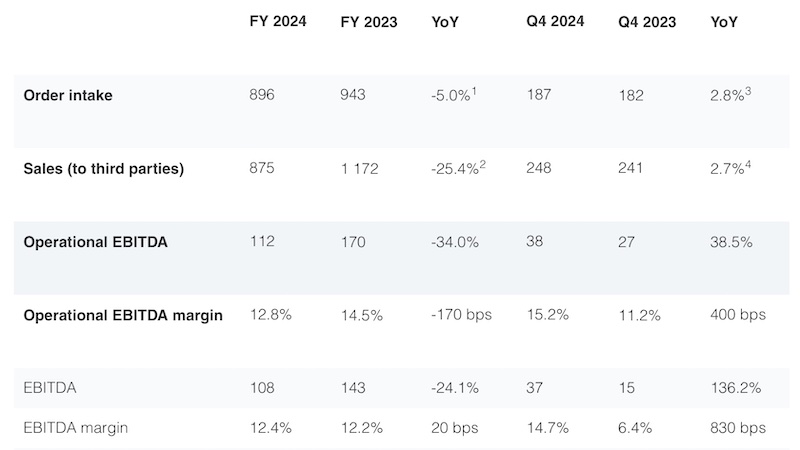

Polymer Processing Solutions Division

Following the filament downturn in 2023, Polymer Processing Solutions’ order intake stabilized year-over-year throughout 2024 (-2.1% at constant FX) and showed a slight increase (+4.1% at constant FX) in Q4. The division saw positive momentum in small- and mid-sized filament orders in 2024. However, sluggish industrial production, as indicated by PMIs, impacted the non-filament business, where H2 orders decreased to 2016 trough levels.

Sales in 2024 at constant currency declined by 23.0%, reflecting the postponement of orders in 2023 (Q4 sales: +4.6% at constant FX).

The division achieved a strong operational EBITDA margin of 12.8% in 2024 (15.2% in Q4) despite 25% lower sales than in 2023 and 43% lower sales than in 2022. This was supported by the early and effective cost measures implemented throughout the cyclical downturn, counteracting lower volume and limited pass-through of higher input costs to maintain volume.

Notably, the Polymer Processing Solutions division launched important innovations in 2024, including advanced energy-efficient technologies and components for manmade fiber production, and new digital applications for atmos.io, the innovative digital environment solution for enhanced productivity and material quality.

Key figures as of December 31, 2024 (CHF million)