Nonwovens / Technical Textiles

Suominen Corporation reports challenging H1/2023 with unchanged outlook

Suominen Corporation’s Half-Year Financial Report on August 9, 2023 at 9:30 a.m. (EEST)

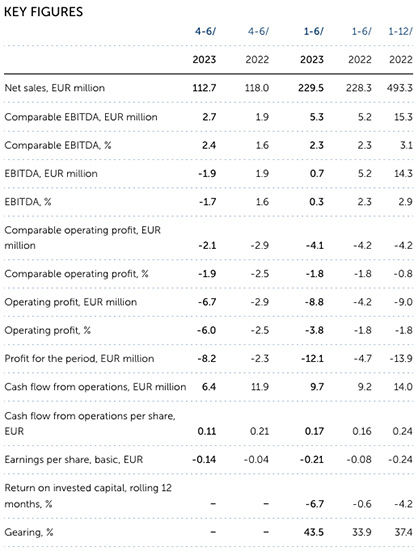

In this financial report, figures shown in brackets refer to the comparison period last year if not otherwise stated. ??April–June 2023 in brief:

- Net sales decreased by 4.5% and amounted to EUR 112.7 million (118.0)

- Comparable EBITDA increased to EUR 2.7 million (1.9)

- Cash flow from operations was EUR 6.4 million (11.9)

- Mozzate plant closure in Italy completed

January–June 2023 in brief:

- Net sales were in line with the previous year and amounted to EUR 229.5 million (228.3)

- Comparable EBITDA was EUR 5.3 million (5.2)

- Cash flow from operations was EUR 9.7 million (9.2)

Outlook for 2023

Suominen expects that its comparable EBITDA (earnings before interest, taxes, depreciation and amortization) in 2023 will increase from 2022. In 2022, Suominen’s comparable EBITDA was EUR 15.3 million.

Tommi Björnman, President & CEO:

“The second quarter of 2023 continued to be challenging for Suominen. Our net sales were EUR 112.7 million (118.0) in the second quarter. Sales volumes were slightly higher compared to the comparison period but sales prices decreased following lower raw material prices.

Our quarterly comparable EBITDA increased to EUR 2.7 million (1.9) mainly due to better sales margins and lower SG&A (Sales, general and administration) costs.

We are continuing to identify and implement actions to improve our financial performance. As part of our improvement actions, we started in January the consultation procedure to permanently close manufacturing at our Mozzate plant in Italy. The consultation procedure was concluded and the production at Mozzate ended in April 2023. We continue our actions to improve operational efficiency in our other plants.

Our investment project in Nakkila, Finland, to strengthen our capabilities in sustainable products by enhancing and upgrading one of the production lines, is proceeding as planned and the project will be completed in the second half of 2023.

Suominen’s strong reputation in the market and comprehensive sustainable product portfolio gives us a solid platform to implement our strategy and further strengthen customer collaboration. Innovation is at the core of our strategy and the sales of new products continued strong, representing over 35% of net sales.

Even though the market challenges continued, the second quarter was operatively slightly better than the first quarter of the year. While market conditions remain uncertain, as there is still a lot of turbulence in the global economy, I am looking forward to our improvement actions to contribute positively to our performance during the second half of the year.”

NET SALES

April–June 2023

In April–June 2023, Suominen’s net sales decreased by 4.5% from the comparison period to EUR 112.7 million (118.0). Sales volumes were slightly higher than in the comparison period, but sales prices decreased following lower raw material prices. The impact of currencies on net sales was EUR -1.6 million.

Suominen’s business areas are Americas and Europe. The net sales of the Americas business area were EUR 69.8 million (64.2) and of the Europe business area EUR 42.9 million (53.8). The main negative impact in Europe is coming from Mozzate plant closure.

January–June 2023

In January–June 2023, Suominen’s net sales were in line with the previous year and amounted to EUR 229.5 million (228.3). Sales volumes were in line with H1/2022 and sales prices were lower. The impact of currencies on net sales was positive EUR 1.7 million.

The net sales of the Americas business area were EUR 144.8 million (126.0) and of the Europe business area EUR 84.7 million (102.3). The main negative impact in Europe is coming from Mozzate plant closure.

EBITDA, OPERATING PROFIT AND RESULT

April–June 2023

Comparable EBITDA (earnings before interest, taxes, depreciation and amortization) was EUR 2.7 million (1.9). The increase was driven mainly due to better sales margins and lower SG&A costs.

The impact of currencies on comparable EBITDA was EUR 0.2 million.

EBITDA was EUR -1.9 million (1.9) due to non-recurring items arising from the closure of production at the Mozzate plant in Italy. The items affecting comparability of EBITDA totaled EUR -4.6 million and consisted mainly of dismissal and restoration expenses.

Comparable operating profit increased from the comparison period and amounted to EUR -2.1 million (-2.9). Operating profit decreased and was EUR -6.7 million (-2.9). The items affecting comparability of operating profit totaled EUR -4.6 million.

Profit before income taxes was EUR -8.0 million (-2.2), and profit for the reporting period was EUR -8.2 million (-2.3).

January–June 2023

Comparable EBITDA (earnings before interest, taxes, depreciation and amortization) was EUR 5.3 million (5.2). Our sales prices were generally lower but were offset by lower raw material, energy and logistics costs. Our other operating income was higher compared to the comparison period mainly due to tax credits in Italy. The impact of currencies on EBITDA was EUR 0.3 million.

EBITDA declined to EUR 0.7 million (5.2) due to non-recurring items arising from the closure of production at the Mozzate plant in Italy. The items affecting comparability of EBITDA totaled EUR -4.6 million and consisted mainly of dismissal and restoration expenses.

Comparable operating profit was EUR -4.1 million (-4.2). Operating profit decreased and was EUR -8.8 million (-4.2). The items affecting comparability of operating profit totaled EUR -4.7 million.

Profit before income taxes was EUR -11.6 million (-4.4), and profit for the reporting period was EUR -12.1 million (-4.7).

FINANCING

The Group’s net interest-bearing liabilities at nominal value amounted to EUR 55.4 million (53.6) at the end of the review period. The gearing ratio was 43.5% (33.9%) and the equity ratio 39.7% (39.0%).

In January–June, net financial expenses were EUR -2.8 million (-0.2), or -1.2% (-0.1%) of net sales. Fluctuations in exchange rates increased the net financial expenses by EUR 0.3 million (decreased by EUR 3.0 million).

Cash flow from operations in April–June was EUR 6.4 million (11.9) and in January–June EUR 9.7 million (9.2), representing a cash flow per share of EUR 0.17 (0.16) and EUR 0.11 (0.21) for the quarter. The cash flows for both the second quarter and H1/2023 include redundancy costs totalling EUR 2.2 million related to Mozzate plant closure.

In the second quarter the change in working capital was EUR 9.0 million (10.9).

The increase in the cash flow from operations in the first half of the year was mainly due to positive change in net working capital as we were able to release cash from inventories and receivables. The change in net working capital was EUR 12.1 million (6.6).

CAPITAL EXPENDITURE

In January–June, the gross capital expenditure totaled EUR 3.7 million (4.0) and was mainly related to normal maintenance investments as well as to the upgrading of one of the production lines in Nakkila, Finland.

Depreciation, amortization and impairment losses for the review period amounted to EUR 9.5 million (9.3).

CLOSURE OF MOZZATE PLANT IN ITALY

Suominen announced on April 14, 2023, that it has completed the consultation procedure with local trade unions regarding the plan to permanently close manufacturing at the Mozzate plant. Following the completion of the process, Suominen moved forward with its plan which led to the closure of manufacturing at the plant and termination of employment of 55 employees in Mozzate.

The terminations resulted in approximately EUR 2.2 million non-recurring expenses which were recognized in the second quarter of 2023. In addition, other non-recurring expenses related to the closure amounted to EUR 2.5 million in the second quarter of 2023.

PROGRESS IN SUSTAINABILITY

We have strong focus on safety and accident prevention, and our long-term target is to have zero lost-time accidents. Unfortunately, during the first half of the year there were 3 (0) LTAs at Suominen sites, but on the other hand our Paulinia plant in Brazil achieved a remarkable milestone of 4,000 days without LTAs.

We systematically measure our employee engagement by conducting our engagement survey, Suominen Vibe, every year. During the first half of 2023, we continued our development actions based on the results from the survey conducted last year. The next Vibe survey is set for autumn 2023.

We are committed to continuously improving our production efficiency and the efficient utilization of natural resources. In the first half we continued our actions to reduce energy consumption, greenhouse gas emissions, water consumption and waste to landfill. Our target is to reduce these by 20% per ton of product by 2025 compared to the base year of 2019.

We offer a comprehensive portfolio of sustainable nonwovens to our customers and continuously develop innovative solutions with a reduced environmental impact. Our target is a 50% increase in sales of sustainable nonwovens by 2025 compared to 2019, and to have over 10 sustainable product launches per year.

Suominen reports progress in its key sustainability KPIs annually.

As part of our Annual Report 2022 published in March 2023 we reported on the progress of our sustainability performance. Our sustainability reporting in 2022 was done in accordance with the GRI Standards from the Global Reporting Initiative and it was assured by an external partner.