#Retail & Brands

Zegna Group reports strong First Half 2022 Results

- Current Trading Supports Increased Guidance: Mid-teens Revenue Growth and Solid Improvement to Adjusted EBIT1 for 2022

- Continued Execution of “Our Road” Strategy Creating Global Growth for Zegna and Thom Browne, on Track to Achieve Mid-term Targets

- Zegna’s Newly Announced Partnership with Real Madrid Expected to Cement One Brand Strategy and Target New Customers

Ermenegildo “Gildo” Zegna, Chairman & CEO, said:

As we conclude the first half of the year, I am proud of the progress that Zegna Group continues to make as we execute our strategic plan, despite ongoing macroeconomic and geopolitical instability, which added to the still ongoing global health crisis, with the US, Western Europe and UAE more than offsetting the impact of Covid-19 related measures in the Greater China Region (“GCR”).

Looking forward, our emphasis will remain on the three pillars of the Our Road strategy. First, we will continue to focus on the Zegna One Brand, which launched in July with a collection of highly recognizable iconic products. Second, we will work to achieve Thom Browne’s full potential, seeking to double revenues by expanding the number of (end) clients, and leveraging customer loyalty and the brand’s unique appeal. Third, we will further strengthen our one-of-a-kind Made in Italy Luxury Textile Laboratory Platform, which is currently seeing sustained levels of production benefitting from healthy orders flows. And we will do all this while staying true to our values, ensuring that sustainability remains at the heart of everything we do and embedding it even further into our business and strategy.

We are already improving store productivity through investment in our people, investments in our stores and the proactive reshaping of our store footprint, the addition of new iconic products and the improvement in sell-through. We are very focused on client outreach through our omnichannel approach, and on innovative partnerships that also target younger consumers. I am particularly excited about our recently announced partnership between Zegna and football club Real Madrid – one of the most recognizable brands in the world with a loyal and enthusiastic fanbase. This partnership will be a tremendous amplifier of our One Brand strategy.

While our current performance is strong, including a healthy rebound in the Greater China Region, the global geopolitical and economic outlook remains uncertain. Through flexibility and discipline, I am confident that we will remain on track, as we execute our strategy to achieve our new 2022 guidance and meet the medium-term targets set out during our Capital Markets Day hosted “at home” in Oasi Zegna on May 17.

1) Adjusted EBIT is a non-IFRS financial measure. See the Non-IFRS Financial Measures section starting on page 12 of this communication for the definition of such non-IFRS measure.

2) All growth rates in this release are year-on-year unless differently specified, and are expressed at actual foreign exchange rates.

Key Financial Highlights from the first half of 2022

Select Highlights

Diversified global presence and broad-based strength

An excellent first half in a still disrupted environment with continued growth momentum for both Zegna and Thom Browne, as US, EMEA and Rest of the World more than offset the impact of COVID-19 related measures in the GCR, showing an acceleration in 2Q 2022 with a growth rate of 59% from 48% in 1Q 2022 (+53% in 1H 2022)

Sound profitability despite increase in costs

Richer product content, positive pricing dynamics, higher sell-through which has increased double-digit (with the exception of GCR), scale effect, fixed cost leverage in B2B from full industrial capacity utilization, and operational and productivity improvements drove an increase in Adjusted EBIT Margin despite the anticipated step up in costs and the less favourable country mix

Launch of Zegna’s One Brand Strategy and progress on Our Road to iconicity

The first collection of the Zegna mono brand was launched in stores in July. The collection was conceived to highlight our new and recognizable brand with a selection of our most iconic products

Continued to tighten the markdowns policy, in all markets (excluding GCR affected by COVID-19-related store closures), on the road to eliminate end of season sales in 2023

Acceleration of store rebranding: 130 stores with the new logo since the launch of the One brand strategy in November 2021

Raising our voice on Our Road to Iconicity: we announced in August that Zegna will become the official luxury travel wear partner of Real Madrid. This is a major step in increasing global awareness of our brand and a key opportunity to reach millions of Real Madrid fans around the world. Inspired by the partnership, specific made to measure collection items that blend the two brands’ heritages as well as Zegna’s contemporaneity aesthetic and its focus on luxury craftmanship, will be available in selected Zegna boutiques globally

Our Road to Traceability. Oasi Cashmere roll out: the pinnacle of our knitwear offering, representing around 20% of Fall/Winter 2022 retail purchases

Our Road to doubling revenues within the Thom Browne segment

Net opening of one directly operated stores (“DOS”) in the first half of 2022, with most of the new stores planned to open during the second half of the year

Met Gala in early May was a key milestone for the brand’s visibility

Staged two fashion shows in the first half: at the end of April in NYC, just before the Met Gala, for FW22, and at the end of June (SS23 Men’s), returning to Paris after over two years. These generated outstanding results in terms of attendance and coverage in global media

Our Road to excellence and traceability with Our Made in Italy Textile Platform

Strong B2B performance in the first half of 2022, with Textile revenues up 55%, and Third Party Brands up 44% y-o-y

Full capacity utilization underpins profitability

Our Road of Responsible Growth: Sustainability Activities and Ambition

Continued to make progress on our previously announced ESG strategy and commitments

In July, we announced our sustainability-linked financing agreements which further embed our ESG commitments into our business and strategy

Targets submitted to Science Based Target initiative (SBTi) in August 2022

Green mobility: at approximately 25% of the journey to reaching 100% fully electric or plug-in hybrid corporate vehicles by 2025 (scope 1)

Review of First Half 2022 Financials

Revenues

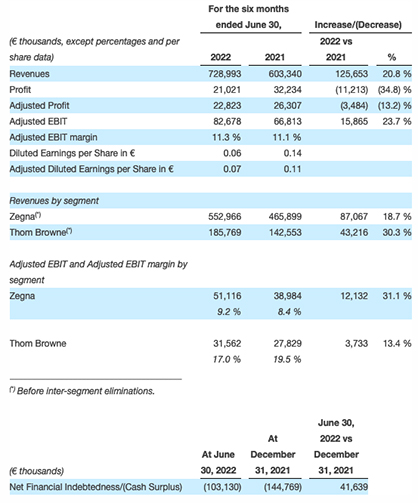

For the first half of 2022, Zegna Group posted revenues of €729.0 million, up 21% y-o-y. In the second quarter of 2022, sales rose by 16% y-o-y to €351.4 million.

Revenues by Segment

Zegna: The Group’s overall performance was driven by the continued strength of the Zegna segment, whose revenues increased 19% y-o-y to €553.0 million. This was a result of the success of the Zegna One brand strategy and repositioning for Zegna-branded products lines. Shoes and luxury leisurewear continued to perform strongly, while tailoring and Made to Measure have rebounded, particularly in the US and EMEA. As illustrated below, the first half of 2022 also saw a strong rebound in the B2B activities of our Made in Italy Luxury Textile Platform and our Third-Party Brands manufacturing.

Thom Browne: Thom Browne continues to contribute strongly to the Group’s overall growth, with revenues up 30% y-o-y for the period, reaching €185.8 million. This is thanks to growth across all lines, and particularly womenswear, and to the rollout of e-commerce through Tmall in the Greater China Region, which was launched in the second half of 2021.

Revenues by Geography

Revenues increased significantly across all major geographies, despite a global environment that remains disrupted by the COVID-19 pandemic and other geopolitical factors. The only exception was the Greater China Region, our largest geographical market, which was affected by COVID-19-related restrictions, primarily from mid-March through the end of May of this year.

Revenues in the Greater China Region amounted to €247.2 million for the first half of 2022, down 14% y-o-y. This is essentially a retail market, hence the decrease was due to lower DTC revenues resulting from temporary store closures and lower customer traffic due to restrictions in major cities across the region. Notably, however, DTC revenues in the Greater China Region for the month of June 2022 increased compared to June 2021 due to the significant increase in e-commerce sales for both the Zegna and Thom Browne segments, and a rebound in sales at our directly operated stores, following the relaxation of COVID-19-related restrictions. In particular, Thom Browne DTC revenues rebounded by double digits compared to June 2021 as a result of strong e-commerce sales and the additional contribution from three new net store openings.

Revenues in the rest of the world amounted to €481.8 million for the first half of 2022, up 53% y-o-y, with an acceleration in 2Q 2022 to 59% from 48% in 1Q 2022. The increase was mainly driven by a 91% y-o-y increase in revenues in the US, reaching €124.3 million, a 43% y-o-y increase in revenues from EMEA to reach €260.6 million, and a strong performance in Japan and the rest of Asia.

Revenues by Channel

Group sales from our directly operated retail network, including e-commerce, were €428.0 million for the first half of 2022, up 13% y-o-y and representing 59% of total revenues. They amounted to €209.9 million in the second quarter of the year, decelerating to a growth rate of 4% relative to the second quarter of 2021. The performance was driven by the success of the brands’ products with local customers and the resumption of tourism in Western Europe, partly offset by the impact of the zero-COVID policies in the GCR.

In particular, DTC revenues from Zegna-branded products were up 6% in the second quarter, compared with 23% in the first quarter. This underlines a strong organic growth and to a lesser extent the contribution of three net store openings compared to June 30, 2021 (including the conversion from wholesale to directly operated stores of twelve Nordstrom points of sale). Similarly, for Thom Browne, second quarter DTC sales were down 2% y-o-y, from +22% in the first quarter. Growth was high double digit in the United States, EMEA and Japan, and included eight net store openings worldwide compared to June 30, 2021.

Importantly, in the month of June DTC revenues in GCR rebounded for both Zegna and Thom Browne, with the former close to June 2021 and the latter up double-digit relative to June 2021.

Wholesale trends in the first half of 2022 (+37% y-o-y) and the acceleration in the second quarter (+45%) is not affected by substantial changes in the timing of the deliveries, with Thom Browne up 89% in 2Q 2022 with broad-based demand strength. Wholesale sales for Zegna-branded products (-3%) reflect the cancellation of Russian orders and the start of FW22 shipments only from July onwards. Elsewhere wholesale revenues grew reflecting the good acceptance of the new One Brand collection by our wholesale partners.

At the end of June 2022, the Group store footprint was comprised of 519 stores (295 DOS) compared with 530 on December 31, 2021 (297 DOS) and 525 on June 30, 2021 (284 DOS).

Revenues by Product Line

All product lines grew double-digit in the first half of 2022 compared to the same period of last year. Zegna branded products were up 13% y-o-y, primarily driven by the continued positive performance of shoes and luxury leisurewear, as well as the rebound of tailoring and Made to Measure offerings, particularly in the United States and EMEA, as well as the effects of price repositioning as part of the One Brand Strategy. Thom Browne’s 30% growth was driven by strong demand for both seasonal and classic products. Textile revenues were up 55% as a result of strong demand across the whole platform and the residual consolidation impact of Tessitura Ubertino (€4.6 million). Finally, Third Party Brands revenues grew 44% thanks to strong deliveries to Tom Ford and Gucci in particular.

Profit and Adjusted Profit

The Group’s profit for the first half of 2022 was €21.0 million, down 35% y-o-y.

The improvement in the operating profit was offset by the €28 million increase in the value of the put option liability on the 10% Thom Browne stake which the Group does not own. The remeasurement of the liability has been driven by (i) a higher present value of the obligation under the put option, in line with the Thom Browne performance and its mid-term ambitions disclosed at the Capital Markets Day; and (ii) the negative foreign exchange impact from a stronger US dollar against the euro. This compares with a €21 million income reported in the first half of 2021 in relation to the purchase of a 5% stake in Thom Browne. Income taxes for the period were €27.1 million, compared to €32.3 million in the first half of 2021, due to a lower pre-tax profit.

Adjusted Profit was €22.8 million. For additional information regarding Adjusted Profit, a non-IFRS measure, please see page 13.

Adjusted EBIT and Adjusted EBIT Margin

The Group’s Adjusted EBIT for the first half of 2022 was €82.7 million, up 24% y-o-y. Adjusted EBIT Margin was 11.3%, up 20bps y-o-y from 11.1%. Adjusted EBIT benefitted from price increases and price repositioning as part of the Zegna One Brand strategy. It also benefitted from purchasing and production efficiencies, which more than offset an increase in costs mainly coming from corporate structure costs, marketing expenses, and other operating charges, which reflect the Group’s growth strategy, and the increase in costs related to being a publicly listed company.

Adjusted EBIT for the Zegna segment was €51.1 million, +31% y-o-y, with an Adjusted EBIT Margin of 9.2%, compared to 8.4% in 2021. This was driven by price increase/repositioning as part of the One Brand strategy, cost efficiencies and positive operating leverage, despite the less favourable country mix and an increase in operating expenses, higher advertising and marketing costs on rebranding activities, higher corporate costs and higher depreciation and amortization. It is worth noting that corporate charges are fully allocated to the Zegna segment.

For the Thom Browne segment, Adjusted EBIT was €31.6 million, up 13% y-o-y, with an Adjusted EBIT Margin of 17.0%, compared to 19.5% in 2021, with scale benefits more than offset by growth-related expenses, including costs for expanding the direct-to-consumer store network (+ 8 net DOS compared to the end of June 2021) and investments to improve central administrative functions and processes.

For additional information regarding Adjusted EBIT and Adjusted EBIT Margin, which are non-IFRS measures, see page 12.

Net Financial Indebtedness / (Cash Surplus) and Capital Expenditure

Cash Surplus was €103.1 million as of June 30, 2022, compared to €144.8 million as of December 31, 2021, and €73.3 million Net Financial Indebtedness as of June 30, 2021, reflecting €28.5 million outflow in capital expenditure (mostly on the store network), compared to €24.6 million in the same period last year), higher Trade Working Capital by €55.2 million and €29.6 million litigation settlements, among other things.

Trade Working Capital as of June 30, 2022, was €331.0 million, compared to €275.8 million as of December 31, 2021, and €289.8 million as of June 30, 2021, reflecting mainly higher inventories (+17% growth y-o-y), built up in preparation for the launch of the One Brand merchandise after June-end and partially deriving from the unsold stock in GCR.

For additional information regarding Net Financial Indebtedness / (Cash Surplus), Trade Working Capital and capital expenditure, which are non-IFRS measures, including a reconciliation of such non-IFRS measures to the most directly comparable IFRS measures, see page 16.

Fiscal Year 2022 Outlook

The first half of 2022 was marked by considerable macroeconomic and geopolitical uncertainty, adding to the volatility of the still ongoing global health crisis. While the Group remains vigilant in the face of these continued uncertainties, (i) we have been witnessing an ongoing positive performance continuing in July and August, and (ii) a strong success of the SS23 selling campaign. We are raising our guidance and now expect revenue growth in the mid-teens (prior guidance was “low-teens”) and a solid improvement (prior guidance was “improvement”) in our Adjusted EBIT, with an Adjusted EBIT margin in the range of last year’s, considering the step-up in marketing and central costs. We also expect a Cash Surplus increase in the second half of the year. This outlook assumes no further deterioration or geographic extension of the war in Ukraine, a continuing normalization of the COVID-19 pandemic in GCR, no significant macroeconomic deterioration and no other unforeseen events.

Medium-term Outlook: Our Path of Responsible Growth

On May 17, 2022, at its first Capital Markets Day, the Group announced its medium-term financial goals. The Group is aiming for revenues to exceed €2 billion and for Adjusted EBIT to reach at least 15% of revenues.

The Group expects, among other things, an increase in store productivity and continuing positive developments related to price and product mix to drive revenues, which, together with favorable operational leverage, should reflect positively on profitability. These improvements should more than offset the planned increase in marketing costs, which, together with capital expenditures (expected at 5% of full-year 2022 revenues), should support our growth.

The Group will continue to pursue its strategy with confidence and determination while monitoring the significant uncertainties, including global health developments, consumer spending in GCR, and global geopolitical and macroeconomic risks.

The ESG targets announced at the Capital Markets Day in May also reaffirm the Group’s commitment to a path of responsible growth, with financial goals rooted in the Group’s values.