#Textile chemistry

Covestro successfully navigates exceptional year 2020

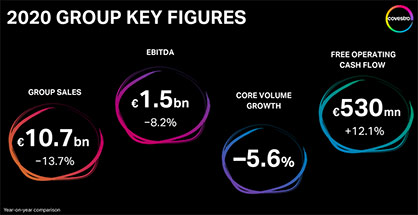

• Core volumes down by 5.6%

• Group sales approximately EUR 10.7 billion (–13.7%)

• EBITDA as forecasted at approximately EUR 1.5 billion (–8.2%)

• Free operating cash flow increased to EUR 530 million (+12.1%)

• Proposed dividend of EUR 1.30, new dividend policy

• Realignment of strategy towards becoming fully circular

• 2021: Fiscal year above pre-pandemic level expected

In 2020, the Group's core volumes sold were down by 5.6% over the prior-year period. Group sales also declined, falling 13.7% year over year to approximately EUR 10.7 billion. By implementing extensive cost-saving measures, Covestro was able to limit the year-over-year decline in EBITDA to 8.2%, finishing fiscal 2020 as forecasted at approximately EUR 1.5 billion (previous year: approx. EUR 1.6 billion). Net income reached EUR 459 million (–16.8%), while free operating cash flow (FOCF) increased to EUR 530 million (+12.1%).

“We were able to successfully navigate through this highly exceptional year and maintained our ability to act at all times. We took a broad range of measures to protect our employees, keep supply chains running, and expand our strong liquidity position,” said CEO Dr. Markus Steilemann. “In fiscal 2020, we therefore were able to actively pursue our strategic goals. We defined our vision to become fully circular and took a major step in this direction with the announced acquisition of the Resins & Functional Materials business from DSM.”

Earlier in 2020, Covestro announced to become fully circular. To fulfill this long-term vision and embed circularity into all areas of its business activities, the Group decided to focus on four topics: alternative raw materials, innovative recycling, joint solutions, and renewable energies.

Strong results thanks to consistent measures

“The decisive measures we took early on helped considerably in delivering strong results. Backed by a significant recovery in demand from mid-year, we returned to our growth trajectory in the second half of the year and generated earnings that almost reached prior-year level,” said CFO Dr. Thomas Toepfer. “In an environment that is still characterized by uncertainty, we remain cost-conscious and continue to strengthen our efficiency. In addition, we are focusing even more explicitly on our customers in order to create value.”

To position itself more robustly in the wake of the coronavirus pandemic and secure liquidity reserves, Covestro implemented numerous additional cost-saving measures last year. As a result, the Group saved a total of EUR 360 million in the short term. The efficiency program “Perspective” launched in 2018 also contributed EUR 130 million in savings in fiscal 2020 and was wrapped up at year-end as announced.

Covestro also pursued various types of financing measures in 2020. In doing so, the Group has aligned its financial instruments with its sustainability performance wherever possible to underscore its commitment to greater sustainability. The syndicated credit facility of EUR 2.5 billion, signed in March 2020, was linked with an Environment, Social, Governance (ESG) rating, for instance. The better Covestro’s ESG performance is, the lower the interest component of the credit facility will be.

Realignment of the strategy: Vision as guiding principle

With the clear goal of becoming fully circular and as an answer to changing market expectations, Covestro has consequently aligned its Group strategy.

This effort is centered on increased customer orientation and sustainable growth. Starting on July 1, 2021, Covestro will manage its business in a new, tailored structure around seven business entities aligned to customer needs and the competitive landscape. Going forward, the Group will distinguish between two business areas, Performance Materials as well as Solutions and Specialties.

• Performance Materials: This area will form a separate business entity and will comprise Standard Polycarbonates, Standard Urethane Components, and Basic Chemicals.

• Solutions and Specialties: This area will consist of the six new business entities Tailored Urethanes, Coatings and Adhesives, Engineering Plastics, Specialty Films, Elastomers, and Thermoplastic Polyurethanes.

Covestro is combining the consistent alignment of products and processes with its customers’ needs with an even sharper focus on addressing sustainability in a profitable way. In the future, the Group will apply sustainability criteria even more stringently when undertaking investments, acquisitions, and R&D activities. As part of its transition towards a circular economy, Covestro is also expanding its portfolio of circular products.

“Our vision to become fully circular is charting the direction of our new Group strategy. The new structure is creating an optimal starting point for the future and will position us to become significantly more competitive,” according to Steilemann. “This will enable us to better meet our customers’ needs, make our company more efficient and effective, and generate sustainable growth. We are truly driving forward the transformation towards a circular economy."

New dividend policy with stronger focus on Group’s earnings

Covestro is setting its dividend payout on a new basis. The dividend policy is based more strongly on the Group's earnings, with the dividend payout ratio amounting to 35% to 55% of the net income generated by the Group. “This dividend policy is more closely linked to Covestro's overall financial position and enables us to increase the dividend in years with strong earnings,” Toepfer said. Based on current performance, Covestro plans to distribute a dividend of EUR 1.30 per share for fiscal 2020. This corresponds to a payout ratio of 55%.

Guidance 2021: Fiscal year above pre-pandemic level 2019 expected

For fiscal 2021, Covestro expects core volume growth of between 10% and 15%. Around 6 percentage points of this figure are attributable to the planned acquisition of the Resins & Functional Materials (RFM) business from DSM, that the Group announced. Moreover, Covestro forecasts FOCF at between EUR 900 million and EUR 1.4 billion, with ROCE between 7% and 12%. The Group's EBITDA for full-year 2021 is anticipated to come in at between EUR 1.7 billion and EUR 2.2 billion. In the first quarter of 2021, the EBITDA range is projected to be EUR 700 million to EUR 780 million.

Recovery in demand across all segments in second half of 2020

The Polyurethanes segment saw core volumes sold decline by 6.1% in fiscal year 2020. Following a drop in demand in the first half of the year due to the coronavirus pandemic, a significant improvement in demand and an advantageous competitive situation in the second half of the year led to an increase in core volumes sold. Sales were down by 13.1% to EUR 5.0 billion for the full year, mainly due to a lower level of average selling prices for the year and the decline in total volumes sold. EBITDA fell by 3.5% to EUR 625 million, also on account of the decrease in volumes sold. However, a lower cost level resulting from cost-saving measures had a positive effect on EBITDA.

The Polycarbonates segment saw core volumes sold drop by 3.0% in fiscal 2020. The pandemic caused demand to dry up in the first six months. In the second half of the year, however, a robust recovery in demand pushed core volumes sold over the prior-year level. Sales were down by 14.1% to EUR 3.0 billion, mainly due to a lower level of selling prices and the decline in total volumes sold. In contrast, EBITDA improved by 3.2% to EUR 553 million, a trend primarily attributable to lower raw material prices and lower costs as a result of cost-saving measures.

The Coatings, Adhesives, Specialties segment's core volumes sold declined by 8.9% in fiscal 2020. In the first six months of fiscal 2020, core volumes sold were down largely because of the sharp drop in demand due to the coronavirus pandemic. By the end of the year, demand had recovered and core volumes sold in the fourth quarter of the 2020 fiscal year exceeded those of the prior year. Sales for the full year slid 13.9% to EUR 2.0 billion, mostly because of the decline in total volumes sold and lower average selling prices. EBITDA dropped by 27.3% to EUR 341 million. This was due to a decrease in volumes sold, lower margins and expenses for the planned acquisition of the RFM business. However, a lower cost level resulting from cost-saving measures had a positive impact on earnings. In addition EBITDA in the prior-year period was positively impacted by a one-time effect from the step acquisition of shares of Japan-based DIC Covestro Polymer Ltd.

Fourth quarter of 2020 well over prior-year level

Core volumes sold in the fourth quarter of 2020 rose by 1.7% over the prior-year period. Group sales therefore increased by 5.0% to EUR 3.0 billion as a result of higher selling prices. At EUR 637 million, EBITDA in the fourth quarter of 2020 more than doubled from the figure in the previous year. Net income climbed sharply from EUR 37 million in the prior-year quarter to EUR 312 million. FOCF also increased in the fourth quarter, by 19.4% to EUR 394 million.