#Spinning

Rieter reports record sales - 2022 figures available

Ad-hoc announcement pursuant to Art. 53 LR

- Record sales of CHF 1 510.9 million, despite enormous challenges in their realization

- Continued high order intake of CHF 1 157.3 million in 2022; order backlog of around CHF 1 540 million as of December 31, 2022

- EBIT margin of 2.1% despite the challenging environment

- Implementation of action plan to increase profitability ongoing

- Dividend of CHF 1.50 per share proposed

- Outlook

Sales, Order Intake and Order Backlog

With record sales of CHF 1 510.9 million, Rieter achieved an increase of 56% compared with the previous year (2021: CHF 969.2 million). In the second half of 2022, especially in the fourth quarter, the measures introduced to address material bottlenecks had a positive impact. Consequently, sales increased to CHF 890.3 million compared with the first six months (first half-year 2022: CHF 620.6 million).

Order intake was CHF 1 157.3 million in 2022 (2021: CHF 2 225.7 million) and thus remained at a high level thanks to the company’s technological lead and broad international presence. The market situation, especially in the second half of 2022, was characterized by investment restraint and below-average capacity utilization at spinning mills due to geopolitical uncertainties, rising financing costs, and consumer reticence in important markets.

The company had an order backlog of around CHF 1 540 million at the end of 2022, which thus extends into 2023 and 2024.

EBIT, Net Profit and Free Cash Flow

The profit at the EBIT level in the 2022 financial year was CHF 32.2 million (2021: CHF 47.6 million). The result was strongly influenced by substantial cost increases, which could only be offset in part through price increases or other remedial measures. In addition, to compensate for material shortages, expenses were incurred in connection with the development of alternative solutions, and in relation to the acquired businesses. In the 2022 financial year, an EBIT margin of 2.1% was achieved (2021: 4.9%) despite these challenges. Rieter closed 2022 with a positive result and achieved a net profit of CHF 12.1 million, equivalent to 0.8% in relation to sales, following a net loss in the first half of 2022.

Free cash flow was CHF -98.6 million, mainly a result of the build-up of inventories for deliveries in the 2023 financial year. Accordingly, net debt was CHF 285.6 million (2021: CHF 161.9 million). As of December 31, 2022, Rieter had liquid funds of CHF 176.1 million (2021: CHF 249.4 million).

The equity ratio as of December 31, 2022, was 23.4%, mainly due to the increased working capital and foreign exchange differences (previous year’s reporting date 27.6%).

Completion of the Acquisition

Rieter consolidated the acquired automatic winding machine business with effect from April 1, 2022. This acquisition completes Rieter’s system offering in the largest market segment of ring and compact spinning, thus significantly strengthening the company’s market position.

Action Plan to Increase Profitability

Implementation of the action plan to increase profitability is ongoing. With regard to the margins for the order backlog, which remains high, the already implemented price increases in combination with a positive trend in costs, particularly in logistics, are having a favorable impact. In addition, progress was made in eliminating material bottlenecks and reducing expenses for the three acquired businesses.

Innovation Program

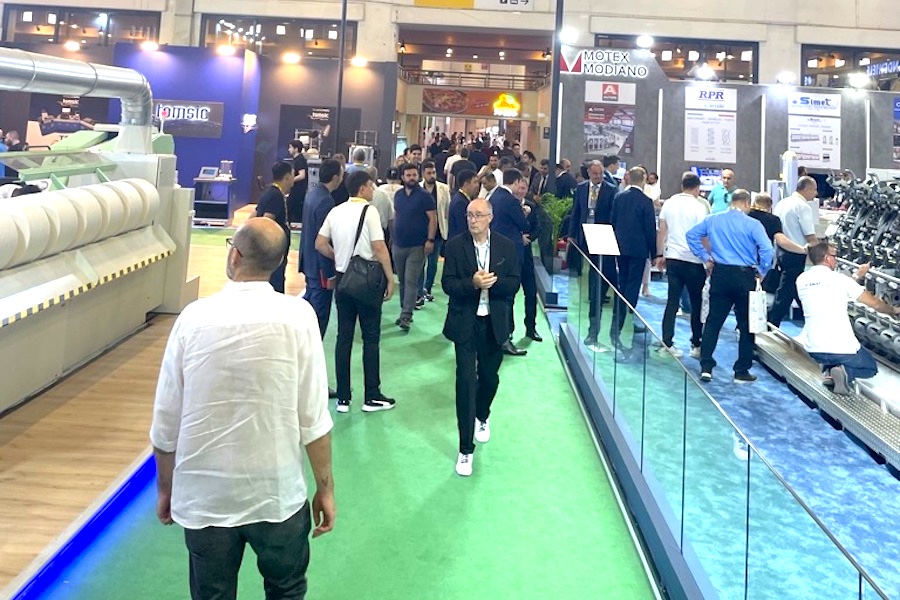

In the context of ITME 2022 in Delhi (India), Rieter presented solutions for the economical production of yarns from recycled fibers, which met with great customer interest. As the technology leader, Rieter will present new, innovative products at ITMA 2023 in Milan (Italy).

Rieter Site Sales Process

The sales process for the remaining land at the Rieter site in Winterthur (Switzerland) is proceeding according to plan. In total, around 75 000 m2 of land will be sold. The Rieter CAMPUS is not part of this transaction.

Dividend

The Board of Directors proposes to the shareholders the distribution of a dividend of CHF 1.50 per share for 2022. This corresponds to a payout ratio of 56%.

Board of Directors and Annual General Meeting

At the 131st Annual General Meeting held on April 7, 2022, the shareholders approved all motions proposed by the Board of Directors. The Chairman of the Board, Bernhard Jucker, and the Directors, Hans-Peter Schwald, Peter Spuhler, Roger Baillod and Carl Illi, were confirmed for a further one-year term of office. Sarah Kreienbühl and Daniel Grieder were newly elected for a one-year term of office as members of the Board of Directors. The members of the Remuneration Committee who were standing for election – Hans-Peter Schwald and Bernhard Jucker – were also re-elected for a one-year term of office. Sarah Kreienbühl was newly elected for a one-year term of office as a member of the Remuneration Committee, and takes over the chair.

Outlook

For the coming months, Rieter expects below-average demand for new equipment at first, with a revival expected in the second half of 2023 after ITMA, the leading trade fair in Milan (Italy). Rieter also believes that demand for consumables, wear & tear and spare parts will recover during 2023.

For the 2023 financial year, due to the high order backlog, Rieter anticipates sales in the order of magnitude of the previous year.

The realization of sales from the order backlog continues to be associated with risks in connection with the ongoing geopolitical uncertainties, rising financing costs, continuing bottlenecks in the supply chains, and possible, currently unforeseeable consequences of the earthquake in Türkiye in February 2023. Despite the price increases already implemented, further global cost increases continue to pose a risk to the growth of profitability. Rieter will specify the outlook in the 2023 semi-annual report.

https://www.rieter.com/media/media-releases/newsdetail/financial-year-2022