#Spinning

First information on the financial year 2019

- As expected, sales were significantly down on the previous year, falling by ?29% to CHF 760 million ?

- EBIT margin of around 11% and net profit of around 7% of sales ?anticipated, non-recurring profit contribution from sale of real estate in ?Ingolstadt (Germany) ?

- Order intake up 7% on previous year; order intake amounting to CHF 401.6 ?million booked in fourth quarter 2019 (4th quarter 2018: CHF 119.0 million) ?

- First half of 2020 expected to be significantly lower than previous year in ?terms of sales and earnings ?

- Further capacity adjustment measures introduced ?

- Start of construction of Rieter CAMPUS expected during 2020, subject to ?granting of building permit

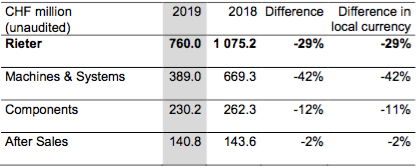

Sales by Business Group

As already reported, 2019 as a whole was characterized by the trade conflict between the USA and China, excess capacity in the spinning mills as well as political and economic uncertainties in regions of importance to Rieter.

Thus, in the Business Group Machines & Systems, with a decline of 42% in the 2019 reporting year, sales of new machines were at a very low level.

In the Business Group Components, the 12% decline in sales compared to the same period in the previous year is also due to the lower order intake as a consequence of reluctance to invest. Above all, this affected the business activities of SSM and Suessen. The wear and tear parts business continued at a normal level.

The 2% year-on-year decline in sales in the Business Group After Sales is mainly attributable to the lower volume in the machinery business (low demand for installation services).

Sales by Regions

The market situation described above is also reflected in sales in the Asian countries, in India and Turkey. Sales in China as well as North and South America remained at the prior year level.

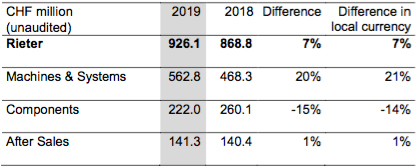

Order Intake by Business Group

The Business Group Machines & Systems posted an order intake of CHF 562.8 million, an increase of 20% compared to the previous year. This is primarily due to the fourth quarter of 2019, in which an order intake of CHF 307.0 million was booked. This figure includes orders from Cotton & Textile Industries Holding Company, Cairo (Egypt), for the delivery of compact and ring spinning systems in the amount of around CHF 165 million.

In the Business Group Components, order intake of CHF 222.0 million was down by 15% compared to the previous year. Due to weaker macroeconomic conditions, order intake in the fourth quarter of 2019 was CHF 49.1 million, lower than in the previous quarters. Overall, the decline in the year under review can be attributed to a low level of investment by customers in the Business Units SSM and Suessen.

With an order intake of CHF 141.3 million, the Business Group After Sales recorded a year-on-year increase of 1%. The fourth quarter of 2019, in contrast, with an order intake of CHF 45.5 million, was significantly higher than the previous quarters, which is largely attributable to the installation services for the Cotton & Textile Industries Holding Company project in Cairo (Egypt).

At the end of 2019, Rieter’s order backlog amounted to about CHF 500 million (December 2018, 31: about CHF 325 million).

First Half of 2020 Expected to Be Significantly Lower Than Previous Year in Terms of Sales and Earnings?

Due to the low order intake in the 2019 financial year, Rieter expects sales and earnings in the first half of 2020 to be significantly below the prior year level.

Further Capacity Adjustment Measures Introduced

The Rieter Group is planning further measures to adjust capacities due to structural changes in the market situation. This concerns the locations Winterthur (Switzerland), Suessen and Gersthofen (both Germany), Enschede (Netherlands) and Boskovice (Czech Republic).

In the Business Group Machines & Systems, the assembly of machines is to be discontinued at the Winterthur location. This is expected to affect 87 jobs out of a total of 980 jobs in Switzerland.

In the Business Group Components, a total of 90 jobs are likely to be lost at the locations Suessen, Gersthofen, Boskovice and Enschede.

The consultation processes with employee representatives begin today, January 29, 2020.

With these measures, Rieter aims to cut running costs by around CHF 15 million from 2021. For the implementation of the adjustment measures, Rieter anticipates non-recurring expenses of approximately the same amount in 2020. The goal remains to successfully implement the ongoing innovation program and to be able to respond quickly to increasing demand.

Start of Construction of Rieter CAMPUS

Rieter applied for a building permit for the Rieter CAMPUS at the end of 2019. The Rieter CAMPUS comprises a new Customer and Technology Center as well as an administration building. The Board of Directors of Rieter Holding Ltd. has decided to start construction work on the Rieter CAMPUS most probably during 2020, provided that the legally building permit is issued in good time.

Profit Outlook for 2019

In financial year 2019, Rieter anticipates an EBIT margin of around 11% (2018: 4.0%) and a net profit of around 7% of sales (2018: 3.0%). This includes the non- recurring profit contribution from the sale of real estate in Ingolstadt in the amount of around EUR 60 million at the net profit level.

Annual General Meeting of April 16, 2020

The 2020 Annual General Meeting of Rieter Holding Ltd. will take place this year on April 16, 2020, at the Eulachhalle arena in Winterthur, Switzerland. Any proposals regarding the agenda must be submitted in writing to Rieter Holding Ltd., Company Secretary's Office, Klosterstrasse 32, CH-8406 Winterthur, Switzerland, by February 22, 2020, at the latest, accompanied by information concerning the relevant motions and evidence of the necessary shareholdings (with a par value of CHF 0.5 million as stipulated by Article 699 of the Swiss Code of Obligations and §9 of the Articles of Association).