#Market Analysis & Forecasts

Current market study forecasts annual growth of 17 % for bio-based polymers between 2023 and 2028

New report released on the global bio-based polymer market 2023 – a deep and comprehensive insight into a dynamically growing market

The year 2023 was a promising year for bio-based polymers: PLA capacities have been increased by almost 50 %, and at the same time polyamide capacities are steadily increasing, as well as epoxy resin production. Capacities for 100 % bio-based PE have been expanded and PE and PP made from bio-based naphtha are being further established with growing volumes. Current and future expansions for PHAs are still on the horizon. After hinting at a comeback in 2022 bio-based PET production dropped in 2023 by 50 %.

In 2023, the total production volume of bio-based polymers was 4.4 million tonnes, which is 1 % of the total production volume of fossil-based polymers. The CAGR of bio-based polymers is, with 17 %, significantly higher than the overall growth of the polymer market (2–3 %) – this is expected to continue until 2028 (Figure 1).

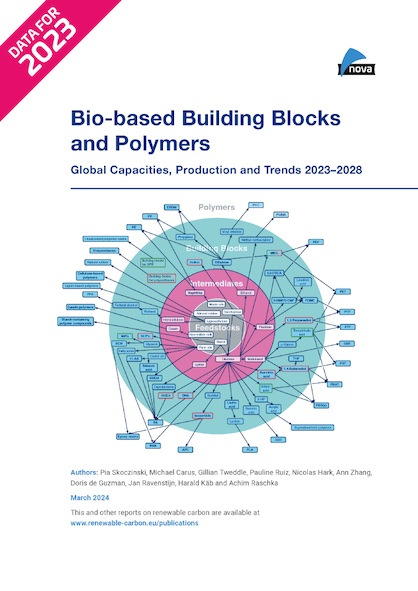

The new market and trend report “Bio-based Building Blocks and Polymers – Global Capacities, Production and Trends 2023–2028”, written by international biopolymer expert group of the nova-Institute, shows capacities and contains production data for 17 commercially available, bio-based polymers in the year 2023 and a forecast for 2028. The report is now available in full length as well as a freely available short version here: https://renewable-carbon.eu/commercial-reports.

From the total 4.4 million tonnes of bio-based polymers produced in 2023, cellulose acetate (CA), with a bio-based content of 50 % and epoxy resins with a bio-based content of 45 % made up over the half of the bio-based production, 24 % and 30 %. Followed by 100 % bio-based polylactic acid (PLA) with 11 %, polyamides (PA) (60 % bio-based content) with 8 % and 30 % bio-based polyurethanes (PUR) with 7 %. Polyethylene (PE) (available with 100 and 30 % bio-based content) and polytrimethylene terephthalate (PTT) (31 % bio-based content) had a share of 6 and 5 % (Figure 2). The share of polybutylene adipate-co-terephthalate) (PBAT), polyethylene terephthalate (PET), polyhydroxyalkanoates (PHA) and starch-containing polymer compounds (SCPC) was below 5 %. Aliphatic polycarbonates (APC; linear and circular), casein polymers (CP), ethylene propylene diene monomer rubber (EPDM), polybutylene succinate (PBS), polyethylene furanoate (PEF) and polypropylene (PP) had a share below 1 % of the total bio-based polymer production volume and are not depicted.

Several global brands are already expanding their feedstock portfolio to include sources of renewable carbon, CO2, recycling and, in particular biomass, in addition to fossil-based sources, thereby increasing the demand for bio-based and biodegradable polymers. At the same time, however, there is a lack of political support in Europe, which still only promotes biofuels and bioenergy. By contrast, supportive legislation is in place in Asia and particularly in the US drives demand.

For 2023, the updated market report includes the following features on 438 pages: Coverage of 16 bio-based building blocks and all 17 commercially available bio-based polymers, comprehensive information on the capacity development from 2018 to 2028, production data for the year 2022 and 2023, per bio-based polymer and analyses of market developments and producers per building block and polymer, so that readers can quickly gain an overview of developments that go far beyond capacity and production figures. Additionally, the market study offers a statistical overview on “Mass Balance and Free Attribution (MBFA)” products available worldwide based on an extensive analysis of the ISCC database, a detailed elaboration on the current European policy for bio-based polymers as well as a comprehensive summary on biodegradability and biodegradable polymers. This information is supported by over 70 figures, over 50 tables and 232 company profiles.

The data published annually by European Bioplastics and the data published by Plastics Europe for 2022 are taken from the market report published by the nova-Institute, albeit with a smaller selection of bio-based polymers and application areas in each case.

Capacity increase

The increase in production capacity from 2022 to 2023 is mainly based on the expansion of PLA and polyamide capacities and epoxy resin production in Asia, as well as an increase in polyethylene (PE) production capacity in South America. Also, worldwide expansions for polyhydroxyalkanoates (PHAs) were reported in 2023. Especially PHAs, PLA, polyamides and PE and PP will continue to grow significantly (35 % on average) by 2028. While capacities for PHA and PLA will grow worldwide with 57 and 37 %, PA will mainly increase in Asia by 29 % and PE in Asia, Europe and North America and PP in North America with 38 % (combined).

Bio-based Feedstock and Land Use

Considering the steadily increasing demand for bio-based polymers, the need for biomass feedstocks should be taken into account as an important factor. This is especially true for the recurring debate on the use of food crops for bio-based polymer production. Figure 3 shows the worldwide biomass utilisation in 2023. The total demand for biomass was 13.5 billion tonnes for feed, bioenergy, food, material use, biofuels as well as bio-based polymers. While the majority of the biomass (56 %) is used for feed production, only 0.029 % are needed for bio-based polymer production. That results in a biomass feedstock demand of 3.9 million tonnes for the production of 4.4 million tonnes of bio-based polymers. The major feedstock used for bio-based polymer production were sugars (28 %) and starch was used with 24 %. These feedstocks are gained from high-yielding crops as sugarcane and maize resulting in high area efficiency.

Additionally, these yields are not only used for polymer production, but also for animal feed, regarding the protein share, and thus only a part is allocated. Glycerol (25 %) a biogenic process by product from biodiesel production represents a biomass with only an indirect, passive land use. This glycerol is mainly used for epoxy resin production via epichlorohydrin as an intermediate. The utilised biomass also comprised 12 % non edible plant oil, such as castor oil, 7 % from cellulose (mainly used for CA) and 4 % from edible plant oil. From the 4.4 million tonnes of produced bio-based polymers (fully and partly bio-based) 2.5 million tonnes were actual bioo-based components of the polymers (57 %). Considering this fact, almost 1.6 times more feedstock was needed than actually is incorporated into the final product. The 1.4 million tonnes (36 %) of feedstock that was not used in the product is due to a high number of conversion steps and related feedstock and intermediate losses, as well as the formation of by products.

Drivers and policy

The most important market drivers in 2023 were several global brands that adapted their strategic agenda to transition the polymers, plastics and chemicals industry to become sustainable, climate friendly and part of the circular economy, thus offering their customers environmentally friendly solutions and critical consumers alternatives to petrochemical products. The only way for this successful transition is the complete substitution of fossil carbon with renewable carbon from alternative sources: biomass, CO2 and recycling (http://www.renewable-carbon.eu). By expanding their feedstock portfolio to include, next to fossil-based, renewable carbon, these brands strike the rethinking from the market point of view. Especially in the use of biomass, this rethinking increased and will further increase the supply of bio-based as well as biodegradable polymers. Nevertheless, the market remains challenging in terms of crude oil prices and from a political perspective, as major advantages of bio-based polymers have not been politically rewarded yet: 1) Bio-based polymers replace fossil carbon in the production process with renewable carbon from biomass. This is indispensable for a sustainable, climate-friendly plastics industry and, 2) Biodegradability is offered by almost the half of the produced bio-based polymers. This should only be a solution for plastics that cannot be collected and enter the environment. In these situations, they can biodegrade without leaving behind microplastics. Only two countries, Italy and Austria will politically support this additional disposal path.

If bio-based polymers were to be accepted as a solution and promoted in a similar way as biofuels, annual growth rates of 20 % and more could be expected. The same would apply, should the oil price rise significantly. Based on the already existing technical maturity of bio-based polymers, considerable market shares could be gained in these cases.

More info:

https://nova-institute.eu/press/?id=516