#Market Analysis & Forecasts

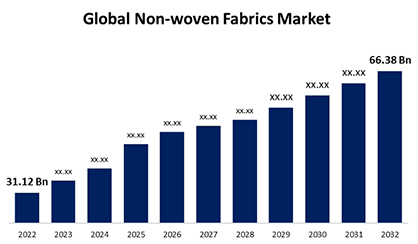

Global non-woven fabrics market size to worth USD 66.38 Billion by 2032 | CAGR of 7.5%

The Global Non-woven Fabrics Market Size to Grow from USD 31.12 Billion in 2022 to USD 66.38 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period.

Non-woven fabrics are made from fibres that are chemically bonded together. These textiles are produced by entwining threads, frequently utilising mechanical, thermal, or chemical bonding methods. Non-woven materials can be used in a wide variety of industries, which has led to this industry's rapid rise. They are used in a wide range of products, including those for hygiene (like diapers and sanitary napkins), medicine (like surgical masks and gowns), geotextiles, and automotive interiors. The demand for non-woven fabrics is affected by a variety of factors, including environmental concerns, technological advancements, and the specific needs of the sectors that utilise these materials.

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the “Global Non-woven Fabrics Market Size By Product (Polyester, Polypropylene, Nylon, and Others); By Application (Disposables and Durables), By Region, And Segment Forecasts, By Geographic Scope And Forecast.”

Non-woven Fabrics Market Price Analysis

Prices for the raw materials required to make non-woven fabrics, like polypropylene, polyester, and other fibres, are quite important. The overall cost of non-woven fabrics might fluctuate depending on the price of raw materials. Costs for various manufacturing procedures, including spunbond, meltblown, and needle punch, vary. Higher capital and operating costs may be associated with more technologically sophisticated operations. Costs may change as a result of investments in new technology and developments. Although advanced technology may help make production processes more efficient, they can also need a larger upfront investment. Pricing for non-woven materials might vary depending on their unique usage. For instance, due to strict quality criteria, medical-grade non-wovens may attract higher pricing.

Non-woven Fabrics Market Opportunity Analysis

Diapers, feminine hygiene products, and medical textiles are just a few examples of the non-woven materials that are rising in demand in the hygiene and medical sectors. Manufacturers can offer specialist, high-performance non-wovens for medical applications including surgical gowns and wound dressings. Businesses might look at options to develop biodegradable or recyclable non-woven materials to meet the need for sustainable products. By extending into underdeveloped nations where the use of non-woven materials is still largely untapped, significant development potential can be identified. Developing countries with increased disposable incomes and changing lifestyles may be the market's main force. For specialist markets or uses, such as filtration, agriculture, or the automotive industry, non-woven fabrics can be tailored.

Due to Growing awareness of personal cleanliness, disposable hygiene products such adult incontinence products, sanitary napkins, and diapers are in higher demand. Non-woven fabrics are a popular choice for these products because of their softness, breathability, and moisture-wicking properties. A greater awareness of health and safety, particularly in the wake of international health crises, has led to an increase in the demand for personal protective equipment (PPE), which includes non-woven medical textiles. Greater awareness has motivated manufacturers to develop and improve the functioning of hygiene products. Because of the rise in demand for hygienic products brought on by greater awareness, the market for non-woven materials has expanded, and new players have joined the market to fill the void.

High raw material costs, especially for synthetic fibres like polyester and polypropylene, may have an effect on manufacturers' profit margins. Manufacturers can have a hard time passing on these additional costs to customers due to pressure from competitors' pricing practises. High operational expenses, such as personnel, energy, and maintenance costs, can have an impact on the overall cost-effectiveness of manufacturing processes. Manufacturers may find it challenging to maintain competitiveness if operational efficiency is compromised. Particularly smaller enterprises may struggle more than larger, more seasoned organisations to control rising costs. This is especially true for the smaller members of the nonwoven fabric business. Industries that create hygiene products and other products that rely heavily on non-woven fabrics may be particularly vulnerable to price swings.

Insights by Product?

The Polypropylene segment accounted for the largest market share over the forecast period 2023 to 2032. Due to its versatility and low cost, polypropylene is preferred when making non-woven fabrics. Its accessibility facilitates its extensive use in numerous applications. The polypropylene category is expanding as a result of uses in medicine and healthcare for surgical gowns, masks, and other medical textiles. Polypropylene is commonly employed due to its barrier properties and sterilising capabilities. Throwaway items are gaining popularity due to their ease of use and rising demand. Polypropylene is the best thermoplastic polymer for manufacturing single-use, disposable non-woven items. Polypropylene is used to make non-woven geotextiles, which are used in landscaping, civil engineering, and building applications. Stabilisation and erosion control are provided by these geotextiles.

Insights by Application

Durable application segment is witnessing the fastest market Growth over the forecast period 2023 to 2032. Non-woven materials are used in automobile interiors for things like upholstery, carpeting, and interior trim. Because of their durability and strength, they are suitable for this market. Non-woven fabrics are used in the construction sector in geotextiles, which are used in soil stabilisation, erosion management, and drainage systems. Durability is crucial for these materials to function well over time in construction projects. Non-woven textiles are utilised in tough packaging applications, such as bulk bags and Non-woven textiles materials, where strength and durability are crucial. Durable non-woven fabrics are used in footwear and clothing for things like shoe linings and interlinings, which increases the longevity and functionality of the finished goods.

Insights by Region

North America is anticipated to dominate the Non-woven Fabrics market from 2023 to 2032. In the North American market, non-woven materials are highly sought-after for use in the manufacture of diapers, feminine hygiene products, and adult incontinence products. The use of non-woven fabrics in medical and healthcare applications, such as surgical gowns, masks, and other medical textiles, has increased demand for these materials. Businesses in North America have formed strategic alliances and made financial investments to expand their production capabilities and satisfy the Growing demand for non-woven materials. Consumer awareness of non-woven materials' benefits in several applications and a focus on comfort and performance continue to shape market developments. The nonwoven fabric market in North America is very competitive, with top players focusing on new product development, technological advancements, and market expansion strategies.

Asia Pacific is witnessing the fastest market Growth between 2023 to 2032. The Growing industrialization and urbanisation of Asia-Pacific countries like China and India has increased the need for non-woven materials in a number of applications. Asia-Pacific is an important region for the manufacture of non-woven fabrics. China is a significant manufacturer and user of nonwoven fabrics on the global market, among other countries. The quality and usefulness of non-woven materials have increased throughout the Asia-Pacific region as a result of ongoing advances in production methods. The Asia-Pacific region's non-woven fabric industry is extremely competitive, with both domestic and foreign companies participating.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major Players in the Global Non-woven Fabrics Market include Nolato AB, Freudenberg Medical LLC, Rochling Group, GW Plastics Inc., MedPlast Inc., Phillips Medisisze Corporation, C&J Industries Inc., Tekni-Plex, Inc., Pexco LLC, Medical Plastic Devices Inc. and Other Key vendors.

Recent Market Developments

• In August 2022, one of the top producers of geosynthetic and erosion control products in the US, Willacoochee Industrial Fabrics, Inc. (WINFAB), recently announced its investment in a brand-new, cutting-edge production line for nonwoven geotextiles in Nashville, Georgia.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Non-woven Fabrics Market, Product Analysis

• Polyester

• Polypropylene

• Nylon

• Others

Non-woven Fabrics Market, Application Analysis

• Disposables

• Durables

Non-woven Fabrics Market, Regional Analysis

• North America

• US

• Canada

• Mexico

• Europe

• Germany

• Uk

• France

• Italy

• Spain

• Russia

• Rest of Europe

• Asia Pacific

• China

• Japan

• India

• South Korea

• Australia

• South America

• Brazil

• Argentina

• Colombia

• Middle East & Africa

• UAE

• Saudi Arabia

• South Africa

More info:

https://www.sphericalinsights.com/reports/non-woven-fabrics-market