#Market Analysis & Forecasts

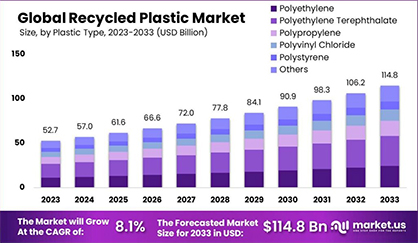

Recycled plastics market to surge at a remarkable 8.1% CAGR from 2024 to 2033, totaling USD 114.8 billion

The global Recycled plastics market is one of the most strictly controlled globally. The market is distinguished by a significant group of players operating worldwide. The increasing consumption of plastics in the construction, automotive, medical equipment, and electrical and electronics sectors is expected to boost the worldwide plastics market.

Recycled plastics are also employed in applications such as packaging to create environmentally friendly and impact-resistant packaging alternatives. Consumers have moved to e-commerce platforms for various products following the pandemic outbreak of COVID-19. As people spend more time at work, demand for packaged and takeout food has increased as people stay late at work to eat it at work. Commonly recycled plastics used as packaging materials include polyethylene terephthalate (PET), polypropylene, polyethylene, and polystyrene.

Key Takeaway:

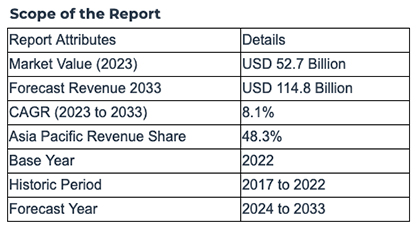

• Market Growth Projections: The Recycled Plastics Market is set to witness robust growth, projected to increase from USD 52.7 billion in 2023 to around USD 114.8 billion by 2033, boasting an estimated CAGR of 8.1% during this period.

• Drivers of Growth: The rise in plastic consumption for lightweight components, particularly in electrical & electronic and building & construction sectors, fuels market expansion. Additionally, the surge in online sales of personal care and protective equipment products further stimulates market growth.

• Plastic Types and Usage: Polyethylene Terephthalate (PET) holds the largest market share (29.3%) due to its extensive use in packaging across food & beverage, consumer goods, and industrial sectors. Polypropylene (PP) is gaining traction in laboratory apparatus, medical gadgets, and automotive, packaging, and construction industries.

• Source Channel Analysis: Plastic bottles contribute significantly (65%) to global recycled plastics revenue, finding applications in oils, pharmaceuticals, and carbonated beverages industries. Polymer foam sheets, particularly Expanded Polystyrene, are widely used in impact-resistant packaging solutions.

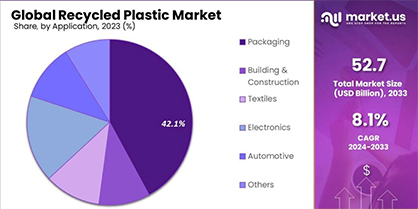

• Application Dominance: The packaging industry constituted over 42.1% of revenue in 2023, driven by increased demand for packaged food, beverages, and electronics. Recycled plastics also witness rising usage in personal hygiene items and automotive components.

• Driving Factors for Adoption: Recycled plastics fulfill the need for safe packaging in the food industry, provide enhanced product durability in various sectors, and are increasingly used in personal care products due to their non-reactive nature.

• Challenges: The collection of raw materials remains a significant challenge, with only 14% of used plastic packaging globally being recycled. Quality concerns and the cost advantage of virgin plastics continue to pose challenges to recycled plastics' widespread adoption.

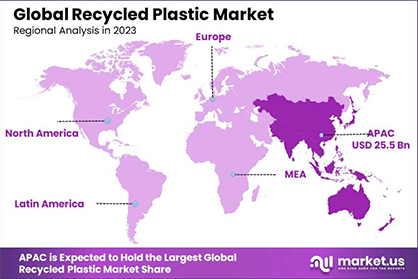

• Regional Insights: Asia Pacific leads the market (48.3%) due to construction industry growth and a circular economy approach. Europe showcases favorable plastic recycling rates owing to strict regulations, while North America experiences significant growth driven by the construction and electronics industries.

Factors are contributing to the growth and revolution of Recycled Plastics Market in the Advanced Materials industry

• Environmental Concerns: Increasing awareness about environmental issues like plastic pollution and the emphasis on sustainability drive the demand for recycled plastics. Consumers, governments, and industries are seeking eco-friendly alternatives to virgin plastics.

• Regulatory Pressures and Policies: Stringent regulations and policies imposed by governments worldwide encourage the use of recycled materials. Mandates, incentives, and taxes often push industries to adopt recycled plastics in their products.

• Technological Advancements: Innovations in recycling technologies are making it more efficient and cost-effective to process recycled plastics. Advanced sorting, purification, and recycling techniques improve the quality and usability of recycled materials.

• Consumer Preferences: Changing consumer preferences and increased awareness of the environmental impact of plastic products are driving demand for recycled plastics. Consumers are often willing to support products made from recycled materials.

• Corporate Sustainability Initiatives: Many companies are embracing sustainability as part of their corporate social responsibility. They are opting for recycled plastics in their packaging, products, and manufacturing processes to reduce their environmental footprint.

• Supply Chain and Economics: Fluctuations in raw material prices, scarcity of resources, and the volatility of oil prices (which influence the cost of virgin plastics) make recycled plastics an attractive economic option.

• Technological Convergence: The integration of recycled plastics into various industries, including automotive, construction, packaging, and electronics, is expanding due to advancements in material science and engineering.

Top Trends in the Global Recycled Plastics Market

• Increased Demand for Post-Consumer Recycled Plastics (PCR): Consumer awareness and corporate sustainability goals are driving the demand for post-consumer recycled plastics. Companies across various industries are prioritizing the use of recycled materials in their products and packaging.

• Technological Innovations in Recycling Processes: Advancements in recycling technologies, such as chemical recycling and mechanical recycling, are enhancing the quality and versatility of recycled plastics. These innovations are enabling the processing of a broader range of plastic types and improving the efficiency of recycling operations.

• Growing Emphasis on Circular Economy Models: The adoption of circular economy principles is gaining traction. Companies are focusing on developing closed-loop systems, ensuring that plastics are recycled and reused in manufacturing processes, thereby reducing waste and environmental impact.

• Regulatory Push for Recycled Content: Governments worldwide are implementing regulations mandating minimum levels of recycled content in products. This pressure is compelling industries to increase their usage of recycled plastics, driving market growth.

• Expansion of Applications: Recycled plastics are finding applications in various industries beyond traditional sectors like packaging. They are being used in automotive parts, construction materials, textiles, and electronics, among others, due to improved quality and performance.

Regional Analysis

In 2023, the Asia Pacific region accounted for the largest market share at 48.3% globally. This growth is attributed to the expansion in the construction industry and the adoption of a circular economy approach. The construction industry's growth leads to increased demand for various materials like flooring, building supplies, fences, and roofing tiles. The region stands as the second-largest market in terms of revenue, primarily driven by initiatives aimed at reducing the environmental impact of traditional plastic production.

Europe has experienced favorable growth in plastic recycling rates, largely due to landfill bans and high costs associated with dumping. This has encouraged the recycling of plastic materials, making recycling more economically viable than discarding in several European nations.

North America ranks third in revenue. The market growth in this region is propelled by the expansion of major industries such as construction and electrical & electronics manufacturing. Additionally, the rising demand for packaged and processed foods contributes to the market's considerable growth, especially in Canada, Mexico, and the United States.

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

• Veolia

• Plastipak Holdings, Inc.

• SUEZ SA

• Ultra Poly Corporation

• Fresh Pak Corporation

• B&B Plastics Recycling Inc.

• Alpek S.A.B. de C.V.

• Indorama Ventures

• Far Eastern New Century Corporation

• Envision Plastics Industries

• Custom Polymers, Inc.

• Berry Global Inc.

• Other Key Players

Market Drivers

• Industry Demand: Increased usage of plastics in various sectors, notably in lightweight components for electrical & electronic and building & construction industries, contributes to market expansion.

• Online Sales: The surge in online sales of personal care and protective equipment products further fuels market growth.

• Packaging Dominance: Packaging industries are major consumers, driven by increased demand for packaged food, beverages, and electronics. Recycled plastics fulfill the need for safe packaging in the food industry, serving as a protective barrier against environmental factors.

• Diverse Application: Recycled plastics are increasingly used in personal hygiene items, automotive components, and various consumer goods.

• Versatility: Recycled plastics enhance product durability in various sectors including sports equipment, fashion accessories, and toys. Their non-reactive nature makes them popular for packaging personal care products.

Market Restraints

• Preference for Virgin Plastics: Despite efforts to promote recycled plastics, industries often prefer virgin plastics due to concerns about quality and specific compositions. Virgin plastics are favored, especially in food packaging and automotive components, for their superior quality.

• Quality Concerns: There's a prevailing perception that virgin plastics maintain better quality compared to their recycled counterparts. Manufacturers, especially in industries requiring precise chemical compositions and additives, still lean toward virgin polymers.

• Cost Advantage for Virgin Plastics: The drop in crude oil prices during the pandemic has made virgin plastics more cost-effective than recycled options. This economic shift poses a challenge for the widespread adoption of recycled plastics, impacting their market growth.

Market Opportunities

• Initiatives for Recycling: Supportive regulations in developed countries encourage plastic recycling.

• Collection Challenges: The major challenge lies in collecting more plastic waste (only 14% currently recycled), with new methods needed to tap into this potential revenue estimated at USD 80–120 billion.

Report Segmentation of the Recycled Plastics Market

Plastic Type

• Polyethylene Terephthalate (PET): Holding a significant share of 29.3%, it finds extensive usage in packaging across industries like food & beverage, consumer goods, and industrial sectors. PET is also used for packaging laundry detergent and milk cartons.

• Polypropylene (PP): Widely utilized in laboratory apparatus, medical gadgets, packaging, and labels due to its exceptional chemical and mechanical qualities. PP is known for its remarkable mechanical strength and resistance to various chemical solvents, bases, and acids. Its demand is expected to rise in the automotive, packaging, and construction industries.

• Polyvinyl Chloride (PVC): Used in various applications such as building materials, health care, electronics, automobile parts, and packaging due to its durability, low cost, and versatility.

• Polystyrene: Commonly used in packaging, disposable cutlery, CD cases, smoke detector housings, and insulation.

• Other Products: This category encompasses other types of recycled plastics used in various applications.

Source Channel

• Plastic Bottles: This segment accounts for a significant portion (65%) of the total global revenue generated from recycled plastics in 2023. Plastic bottles are used in various industries, including the packaging of oils, pharmaceuticals, carbonated beverages, and other liquids.

• Plastic Films: Another source channel for recycled plastics, plastic films find applications in diverse industries. They are used for packaging and protective purposes, especially in sectors requiring flexible and thin plastic materials.

• Polymer Foam: Polymer foam, including expanded polystyrene (EPS), is extensively used in impact-resistant packaging solutions. Within the automotive and electronic industries, companies like Hitachi, Panasonic Corporation, and Honda Motor Company Ltd. are shifting towards adopting recycled plastic foam over virgin polymer foam.

• Other Sources: This category may encompass additional channels contributing to the availability of recycled plastics, beyond plastic bottles, films, and polymer foam. These sources could include various forms of plastic waste from different industrial and consumer sectors.

Application Analysis

The packaging industry holds a significant share of the market, accounting for over 42.1% of global revenue in 2023. This dominance is driven by increased demand for packaged food, beverages, and electronics. The primary application fields propelling growth in this market include personal hygiene items like electric trimmers and shavers, as well as automotive components.

The Asia Pacific packaging industry is expanding and adopting cutting-edge technology. This expansion is attributed to increased demand for products and consumer goods in the region, including electrical & electronic equipment, building & construction materials, and other raw materials. The industry's growth in the Asia Pacific region is driven by a flexible regulatory environment, overcoming limitations frequently found in Western markets. Moreover, rapid growth in electronics spending is anticipated in this region.

Market Segments

Plastic Type

• Polyethylene

• Polyethylene Terephthalate

• Polypropylene

• Polyvinyl Chloride

• Polystyrene

• Other Products

Source

• Plastic Bottles

• Plastic Films

• Polymer Foam

• Other Sources

Application

• Building & Construction

• Packaging of Products

• Electrical & Electronics

• Textiles

• Automotive

• Other Applications

By Geography

• North America

- The US

- Canada

• Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

• APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

• Latin America

- Brazil

- Mexico

- Rest of Latin America

• Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Recent Developments

• September 2022 Update: WM Recycle America, LLC plans to buy Avangard Innovative’s U.S. operations and rename it Natura PCR. They aim to boost recycling capacity, targeting an impressive 400 billion pounds of post-consumer resin (PCR) annually within five years.

• January 2022 Development: Plastipak Holdings, Inc., a plastic container design and recycling leader, invested big to amp up PET recycling at its Bascharage, Luxembourg facility. This move is expected to increase manufacturing capacity by 136% each year.

More Info:

https://market.us/report/recycled-plastics-market/