#Raw Materials

Textile Exchange’s latest report aims to drive a shift away from unchecked resource extraction in fashion, apparel, and textile

Detailed in the Reimagining Growth Landscape Analysis is the case for pivoting business success in the industry from the traditional interpretation of growth to a model aligned with “regenerative economy” and “post-growth” principles. This will be necessary not only to bring it back in line with the planet’s limits, but to ensure its own resilience, mitigating future risks associated with supply chain instability, resource depletion, overreliance on finite resources, and incoming legislation.

Beyond outlining the risks of business-as-usual, the Reimagining Growth Landscape Analysis looks at the potential pathways for value creation through an approach that respects both environmental and social imperatives, contributing to a better future for all.

Download the report

https://textileexchange.org/app/uploads/2024/12/Reimagining-Growth-Landscape-Analysis.pdf

Discover some of the key takeaways

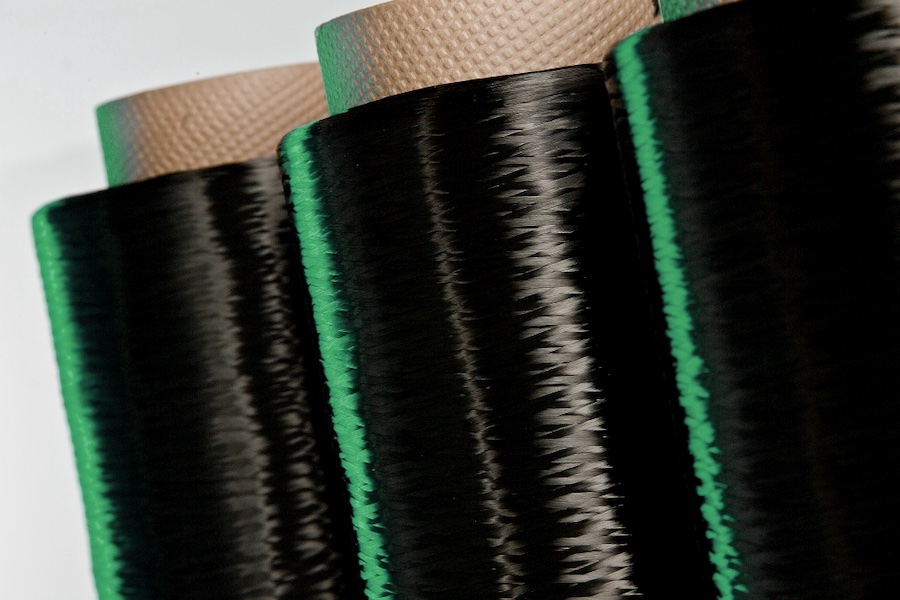

+ Reimagining growth looks different for every material. For virgin fossil-based synthetics, Textile Exchange advocates for phasing them out as quickly as possible. For natural materials, it’s about ensuring the availability of sustainably sourced renewable materials—like regenerative and organic options—while limiting growth to protect the conversion of pristine ecosystems.

+ Growth as it has been traditionally defined — whether in terms of sales, production, or market share — is deeply ingrained in overarching financial systems and corporate culture. In most cases, pressure to prioritize growth outweighs sustainability goals, particularly when facing investors and shareholders who are accustomed to short-term financial returns.

+ A significant challenge associated with elevating this topic to business leaders is terminology. An industry survey conducted as part of the research for this report indicated a lack of alignment on a single term that accurately and clearly articulates the concepts for all stakeholders. However, the report emphasizes that this should not hinder progress.

+ Pathways for change at the raw material level include eliminating the use of virgin fossil-based synthetic materials and championing sustainably sourced renewable and closed-loop, textile-to-textile recycled feedstocks. Designing durable, high-quality products and scaling circular business models, such as repair, rental, resale, and responsible take-back initiatives, will also be key, as well as eliminating marketing practices that drive overconsumption and supporting consumer awareness, education, and engagement instead.

+ These pathways require systemic support, advocating for ambitious government policy and collective corporate commitment to accelerate the transition to a post-growth model. Ensuring a just transition — protecting the rights, livelihoods, and well-being of people across the value chain — is also essential, making space for contributions from all stakeholder groups to leave no one behind.

+ The shift that needs to occur for transformational change is at the market level, rather than just at the individual business level, and it cannot be achieved by a single brand or the textile industry alone. Businesses should explore the role they can play in helping to drive this shift, sharing best practices and learnings to support others to follow suit.