#Textiles & Apparel / Garment

Inditex interim half year 2022 results

/ In 1H2022, Inditex’s fully integrated model had a very strong operating performance. Sales, EBITDA and net income reached historic highs

/ Oscar García Maceiras, CEO, “The results are explained by four factors, key to our performance. Our unique fashion proposition, an increasingly optimised shopping experience for our customers, our focus on sustainability, and the talent and commitment of our people. Our business model is progressing at full pace and has great growth potential going forward”

/ Sales reached €14.8 billion (+24.5% versus 1H2021). Sales in constant currencies grew 25%. Sales were positive in all key geographical areas

/ Over 1H2022, Inditex traffic and store sales increased markedly and continue to do so, with store differentiation being key to this dynamic. Online sales progressed satisfactorily and were positive in 2Q2022. Online sales are expected to exceed 30% of total sales by 2024

/ In 1H2022, the execution of the business model was very strong. Gross profit increased 24.5% to €8.6 billion. The gross margin reached 57.9%, the highest in 7 years. Based on current information, Inditex expects a stable gross margin (+/-50 bps) for FY2022

/ The control of operating expenses has been rigorous. Operating expenses increased by 20%, below sales growth

/ EBITDA increased 30% to €4 billion. Inditex has provisioned all expected expenses for FY2022 in the Russian Federation and Ukraine. An extraordinary charge of €216 million was recorded in the 1Q2022 accounts under Other results

/ EBIT increased 44% to €2.4 billion and PBT 42% to €2.3 billion

/ Net income increased 41% to €1.8 billion

/ Given the strong execution of the business model, cash from operations has grown significantly. The net cash position grew 15% to €9.2 billion

/ The FY2021 final dividend of €0.465 per share will be paid on 2 November 2022

/ Autumn/Winter collections have been very well received by our customers. Store and online sales in constant currency between 1 August and 11 September 2022 increased 11% versus the record period in 2021

/ At current exchange rates Inditex expects a +0.5% currency impact on sales in FY2022

Interim Half Year 2022: Very strong execution

Inditex continues to focus on four key areas: A unique product proposition, enhancing the customer experience, sustainability, and the talent and commitment of our people.

The Spring/Summer collections were very well received by our customers. Sales reached €14.8 billion, +24.5%. Sales in constant currencies grew 25%. Sales were positive in all key geographical areas.

Over 1H2022, Inditex’s traffic and store sales increased markedly and continue to do so, with store differentiation being key to this dynamic. Online sales progressed satisfactorily and were positive in 2Q2022. Online sales are expected to exceed 30% of total sales by 2024.

In 1H2022, openings have been carried out in 24 markets. At the end of the period, Inditex operated 6,370 stores. A list of total stores by concept is included in Annex I.

Net sales by concept in 1H2022 and 1H2021 are shown in the table below:

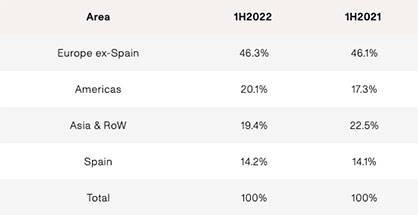

Inditex continues to roll out its global sales platform. Store and online sales by geographical area are shown in the table below.

In 1H2022, the execution of the business model was very strong. Gross profit increased 24.5% to €8.6 billion. The gross margin reached 57.9% (+2 bps), the highest in 7 years. Based on current information, Inditex expects a stable gross margin (+/-50 bps) for 2022.

The control of operating expenses has been rigorous. Operating expenses increased by 20%, below sales growth.

In 1H2022, EBITDA increased 30% to €4 billion. Inditex has provisioned all expected expenses for FY2022 in the Russian Federation and Ukraine. An extraordinary charge of €216 million was recorded in the 1Q2022 accounts under Other results.

EBIT increased 44% to €2.4 billion and PBT 42% to €2.3 billion.

Annex 2 includes a breakdown of the Financial Results.

The tax rate applied to the 1H2022 results is the best estimate for the fiscal year 2022 based on available information.

Net income increased 41% to €1.8 billion.

Given the strong execution of the business model, cash from operations has grown significantly. The net cash position grew 15% to €9.2 billion.

In the face of possible supply chain tensions going into 2H2022, Inditex has temporarily accelerated Autumn/Winter inventory inflows in order to increase product availability without any change to commitment levels. Due to this reason, inventory as of 31 July 2022 increased 43%. The Autumn/Winter inventory is considered to be of high quality and is consistent with the strong sales trends in previous quarters and the sales performance going into the 2H2022. As of 11 September 2022, inventory levels were 33% higher.

Start of 2H2022

The Autumn/Winter collections have been very well received by our customers.

Store and online sales in constant currency between 1 August and 11 September 2022 increased 11% versus the record period in 2021.

Dividend

The FY2021 final dividend of €0.465 per share will be paid on 2 November 2022.

Outlook

Inditex continues to see strong growth opportunities. Our key priorities are to continually improve the product proposition, to enhance the customer experience, to maintain our focus on sustainability and to preserving the talent and commitment of our people. Prioritising these areas will drive long-term organic growth.

The flexibility and responsiveness of the business in conjunction with in-season proximity sourcing allows a rapid reaction to fashion trends and allows us to enjoy a unique market position. Our business model has great growth potential going forward.

At current exchange rates Inditex expects a +0.5% currency impact on sales in FY2022.

Online sales are expected to exceed 30% of total sales by 2024.

In 2022, Inditex expects a stable gross margin (+/-50 bps).

The future growth of the Group is underpinned by the investment in our stores, the advances made to the online sales channel and the improvements to our logistics platforms with a clear focus on innovation and technology. We estimate investments in 2022 of around €1.1 billion.

The interim nine months 2022 results will be published on 14 December 2022.

Sustainability

Sustainability is a key part of Inditex’s strategy. As per the Sustainability Roadmap Goals, Inditex is on track to deliver upon all of the targets set for 2022, 2023 and 2025.

As part of Inditex’s Sustainability Innovation Hub, we are participating in an innovative start-up, CIRC, which develops a technology that provides a solution for one of the challenges facing our industry: the industrial scale recycling of textile products composed of polyester and cotton, accounting for most of the fabrics manufactured. The technology developed by CIRC makes it possible to convert these mixtures, regardless of the ratio of their composition and colour, into new fibres, such as cellulose pulp for viscose and lyocell.

As part of our drive towards improved sustainability, Inditex is a partner in the Regenerative Production Landscape Collaborative (RPLC) program, in which the Laudes Foundation, IDH The Sustainable Trade Initiative, WWF India, Action Social Advancement (ASA) and other brands, government actors, the private sector and the civil sector collaborate to promote regenerative agriculture and ecosystem restoration in an area of 300,000 hectares in the states of Madhya Pradesh and Odisha (India). This commitment to regenerative and restorative agriculture will result in the improvement of soil quality and biodiversity in the area, the optimisation of water management and the reduction of greenhouse gas emissions from agriculture, among other environmental impacts. In addition, the project has an important social focus, as it will improve the lives of more than 75,000 farming families and their communities.

The consolidated financial statements and Annex are available here:

https://www.inditex.com/itxcomweb/api/media/4e8ede5a-6720-4942-b0a1-24375285d054/Inditex_Interim+Half+Year+2022+Results.pdf?t=1663137240272