#Yarn & Fiber

Lenzing implements comprehensive performance program in response to lack of market recovery

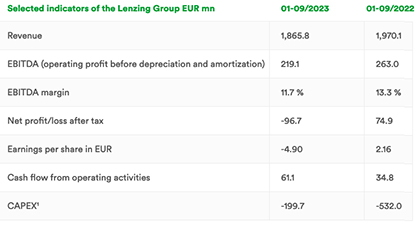

- Revenue of EUR 1.87 bn and EBITDA of EUR 219.1 mn in the first three quarters of 2023

- Positive free cash flow of EUR 27.3 mn in the third quarter

- Implementation of performance program focusing on positive free cash flow, strengthened sales and margin growth and sustainable cost excellence

- Modernization and conversion of Indonesian site successfully completed – EU Ecolabel received

Revenue in the first three quarters of 2023 decreased by 5.3 percent year-on-year to EUR 1.87 bn. This reduction was primarily due to lower fiber revenues, while pulp revenues were up. The earnings trend was mainly influenced by the market environment. As a consequence, earnings before interest, tax, depreciation and amortization (EBITDA) in the reporting period decreased by 16.7 percent year-on-year to EUR 219.1 mn. The net result after tax amounted to minus EUR 96.7 mn (compared with EUR 74.9 mn in the first three quarters of 2022), while earnings per share amounted to minus EUR 4.90 (compared with EUR 2.16 in the first three quarters of 2022).

“The recovery that has been expected for the second half of the year in the markets relevant that are for us has so far failed to materialize. As a consequence, the measures we took at an early stage have proved all the more correct. We already launched an ambitious cost-cutting program at the end of 2022, which has delivered the expected results ahead of schedule. Building on this, we are currently implementing a holistic performance program with a focus on measures to boost profitability and cash flow generation as well as to leverage growth potential in the fiber markets through targeted sales activities,” comments Stephan Sielaff, Lenzing Group CEO.

Nico Reiner, Lenzing Group CFO, adds: “This performance program enables us to powerfully tackle the current economic challenges and to strengthen Lenzing’s resilience to crises.”

Effective measures launched

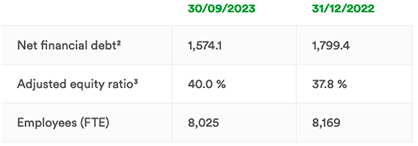

As early as the end of 2022, Lenzing successfully implemented a reorganization and cost reduction program with a volume in excess of EUR 70 mn, while also implementing further measures to strengthen free cash flow. In the third quarter of 2023, Lenzing generated positive free cash flow of EUR 27.3 mn. At the same time, the balance sheet and liquidity position were significantly strengthened through the successful capital increase of around EUR 400 mn and the extension of the debt terms in the reporting period.

Building on this, the Managing Board is currently implementing a comprehensive performance program with the overriding objective of significantly enhanced long-term resilience to crises and greater agility in the face of market changes. The program initiatives are aimed at generating free cash flow, stronger revenue and margin growth, and sustainable cost excellence. In addition to the positive effects on sales, the Managing Board expects annual cost savings of more than EUR 100 mn, of which approx. 50 percent will be effective from the coming financial year.

As in past programs, some of the cost reductions will derive from a reduction in personnel costs. It is currently assumed that global personnel costs will be reduced by up to EUR 30 mn, or around 500 full-time equivalents (FTE), which will be achieved by not filling positions that fall vacant due to retirements and natural attrition, as well as by staff reductions. For the Austrian sites in Lenzing and Heiligenkreuz, negotiations are currently underway with the works council concerning a social plan, the implementation of which is scheduled to commence in the first quarter of 2024.

During the reporting period, Lenzing also successfully implemented a capital increase with subscription rights for existing shareholders. The gross issue proceeds of approximately EUR 400 mn are being deployed to strengthen the balance sheet and liquidity position, to create additional flexibility in relation to the financing strategy and to support the Better Growth strategy.

“Better Growth” further advanced

Implementation of the “Better Growth” corporate strategy continued in the reporting period. This strategy is aimed, among other things, at better serving structural demand growth for eco-friendly and high-quality specialty fibers of the TENCEL™, LENZING™ ECOVERO™ and VEOCEL™ brands. After the successful conversion of a production line in Nanjing (China) in the first quarter of 2023, Lenzing was also able to complete its conversion and modernization measures in Purwakarta (Indonesia) in the third quarter with the aim of converting to specialty viscose and significantly reducing specific emissions. Viscose fibers produced at the site under the LENZING™ ECOVERO™ and VEOCEL™ brands are marked with the EU Ecolabel,[1] an internationally recognized eco label for environmentally responsible products and services.

Lenzing is therefore able to generate 100 percent of its fiber sales with specialty fibers from the TENCEL™, LENZING™ ECOVERO™ and VEOCEL™ brands.

Outlook

According to the IMF, a full return of the global economy to pre-pandemic growth rates appears increasingly out of reach in the coming quarters. In addition to the consequences of the pandemic and the ongoing war in Ukraine, growth is also being influenced by restrictive monetary policy and extreme weather events. The consequences of the renewed military confrontation in the Middle East are not yet foreseeable. Overall, the IMF warns of greater risks to global financial stability, and expects the growth rate to decrease to 3 percent this year and to 2.9 percent next year.

The currency environment is expected to remain volatile in the regions of relevance to Lenzing.

The general market environment is continuing to weigh on the consumer climate and on sentiment in the industries relevant to Lenzing.

In the trend-setting market for cotton, the current 2023/24 crop season is emerging as a further 1.7 mn tonnes of inventory build-up, following 1.8 mn tonnes of inventory build-up in the previous season.

Earnings visibility remains severely limited overall.

Lenzing is fully on track with the implementation of the reorganization and cost reduction program and on this basis is implementing a comprehensive performance program focused on positive free cash flow, strengthened sales and margin growth as well as sustainable cost excellence. The overarching goal is to position Lenzing even more strongly and to further increase its crisis resilience.

In structural terms, Lenzing continues to anticipate growth in demand for environmentally responsible fibers for the textile and clothing industry as well as the hygiene and medical sectors. As a consequence, Lenzing is very well positioned with its “Better Growth” strategy and plans to continue driving growth with specialty fibers as well as its sustainability goals, including the trans-formation from a linear to a circular economy model.

The successful implementation of the key projects in Thailand and Brazil as well as the investment projects in China and Indonesia will further strengthen Lenzing’s positioning in this respect.

Taking the aforementioned factors into consideration, the Lenzing Group continues to expect that EBITDA for the 2023 financial year will lie in a range between EUR 270 mn and EUR 330 mn.

[1] The EU Ecolabel is recognized by all member states of the European Union as well as Norway, Liechtenstein and Iceland. Introduced in 1992 by an EU regulation (Regulation (EEC) No. 880/92), the voluntary label has gradually become a reference for consumers who wish to contribute to a lower environmental impact by purchasing more environmentally responsible products and services.

1) Capital expenditures: Investments in intangible assets, property, plant and equipment and in biological assets as per the consolidated statement of cash flows

2) Since the second quarter of the 2023 financial year, net financial debt is presented excluding lease liabilities (see the supplement to the management report “Notes on the Financial Performance Indicators of the Lenzing Group”).

3) Ratio of adjusted equity to total assets in percent