#Denim

Levi Strauss & Co. reports first-quarter 2022 financial results, exceeding expectations

"Our teams’ disciplined execution of our strategic priorities enabled us to deliver strong top and bottom-line growth as we capitalize on structural tailwinds and successfully manage a dynamic operating environment. The strength of our brands and strategy position us to deliver sustainable growth well into the future."

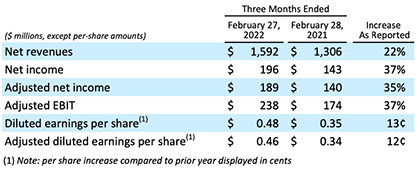

Financial Highlights for the First Quarter

• Reported net revenues of $1.6 billion up 22%, and 26% on a constant-currency basis, versus Q1 2021 driven by strong growth across all geographical segments

- Global Direct-to-Consumer reported net revenues up 35% versus Q1 2021; reflecting a 48% increase in company-operated stores and a 10% increase in e-commerce

- Global Wholesale reported net revenues up 15% versus Q1 2021

- Net revenues through all digital channels grew 16% and represented approximately 25% of total ?first quarter net revenues

- Supply chain constraints impacted net revenues by approximately $60 million

• Gross margin was 59.3%; Adjusted gross margin was 59.4%, up 170 basis points from Q1 2021

• Operating margin was 14.7%; Adjusted EBIT margin of 14.9%, up from 13.3% in Q1 2021

• Net income was $196 million; Adjusted net income was $189 million up from $140 million in Q1 2021

• The effective income tax rate was 20.4% compared to 7.9% in Q1 2021

• Diluted EPS was $0.48; Adjusted diluted EPS was $0.46, up from $0.34 in Q1 2021

"We achieved excellent financial results in the first quarter, driving strong double-digit revenue growth and record gross margin enabling us to deliver adjusted EBIT margin of 14.9 percent," said Harmit Singh, chief financial officer of Levi Strauss & Co. "The ongoing consumer demand across our portfolio of brands and our proven ability to deliver profitable growth give us the confidence to reaffirm our full-year outlook despite the incremental headwinds from ongoing macro challenges."

Highlights include:

First-Quarter 2022 Details:

• Net revenues of $1.6 billion increased 22% on a reported basis, and 26% on a constant-currency basis excluding $38 million in unfavorable currency impacts.

– DTC net revenues increased 35%, driven by both company-operated stores and e-commerce. As a percentage of first quarter company net revenues, sales from DTC stores and e-commerce comprised 30% and 9%, respectively, for a total of 39%.

– Wholesale net revenues increased 15% reflecting strong demand for the Levi's® brand globally.

– The company’s global digital net revenues grew approximately 16% compared to the same period ?in the prior year and comprised approximately 25% of first quarter fiscal 2022 net revenues.

• Gross profit was $944 million, as compared to $760 million in the same quarter in the prior year. Gross margin was 59.3% of net revenues, up from 58.2% in the same quarter of the prior year. Adjusted gross margin, which excludes COVID-19 and acquisition-related charges, was 59.4%, an increase of 170 basis points compared to the same period in the prior year. The increase in gross margin reflects a higher proportion of sales in our DTC channel, lower promotions, higher share of full price sales and price increases, partially offset by higher product costs.

• Selling, general and administrative (SG&A) expenses were $709 million compared to $583 million in the same quarter in the prior year. Adjusted SG&A in the first quarter of fiscal 2022 was $708 million compared to $579 million in the same quarter in the prior year. As a percentage of net revenues, adjusted SG&A was 44.5%, approximately 20 basis points higher than the prior year period, reflecting higher investments in advertising and promotion and higher distribution expenses, partially offset by leverage in selling expenses.

• Operating income of $234 million compared to $177 million in the same quarter in the prior year. Adjusted EBIT of $238 million compared to $174 million in the same quarter of the prior year. The increases were primarily due to higher net revenues and gross margin partially offset with higher SG&A expenses in the current year.

• Net income was $196 million compared to $143 million in the same quarter of the prior year and Adjusted net income was $189 million compared to $140 million in the same quarter of the prior year. The company recognized lower interest expense offset with higher income taxes. Additionally, the company recognized a COVID-19 government subsidy gain within net income in the current year.

• The effective income tax rate was 20.4% for the first quarter, compared to 7.9% for the same prior-year period. The increase in the effective tax rate was primarily driven by lower tax benefit from the foreign derived intangible income deduction and stock-based compensation equity awards in the quarter as compared to the same prior-year period.

• Adjusted diluted earnings per share increased to $0.46 as compared to $0.34 for the same prior-year period.

Additional information regarding Adjusted gross margin, Adjusted SG&A, Adjusted EBIT, Adjusted EBIT margin, Adjusted net income, Adjusted diluted earnings per share, as well as amounts presented on a constant-currency basis, all of which are non-GAAP financial measures, is provided at the end of this press release.

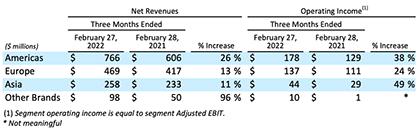

First-Quarter Segment Overview

Reported net revenues and operating income for the quarter are set forth in the table below:

• In the Americas, net revenues grew 26% on a reported basis and 27% on a constant-currency basis, driven by growth across both our DTC and wholesale channels. DTC net revenues increased 31% due to strength in company-operated stores as consumers returned to in-person shopping. Wholesale net revenues grew 24%, driven by strong performance across brands, particularly the Levi’s® brand. Net revenues through all digital channels grew 24% and represented 24% of the segment's sales in the quarter. Operating income for the segment increased due to higher net revenues and gross margins.

• In Europe, net revenues grew 13% on a reported basis and 21% on a constant-currency basis. DTC net revenues increased 46%, driven by strength in company-operated stores as the severity of the pandemic lessened, allowing consumers to return to our stores. Wholesale net revenues decreased 4% on a reported basis while increasing 3% on a constant-currency basis. Net revenues through all digital channels declined 8% following an 84% increase in the same period last year and represented 29% of the segment's sales in the quarter. ?Operating income for the segment increased due to higher net revenue and gross margins, partially offset by higher SG&A expenses as a percentage of net revenues.

• In Asia, net revenues increased 11% on a reported basis and 14% on a constant-currency basis. The increase in net revenues was driven by both our DTC and wholesale channels and most markets, despite a few markets continuing to experience COVID-related impacts. DTC net revenues increased 17% driven by strong performance in our company-operated stores, as well as e-commerce, which was up 22%. Wholesale net revenues increased 5% driven by strength of the Levi’s® brand across several markets. Net revenues through all digital channels grew 17% and represented 14% of the segment's sales in the quarter. Operating income for the region increased due to higher net revenue, gross margin, and lower SG&A expenses as a percentage of net revenues.

• For Other Brands, Dockers® and Beyond Yoga® combined, net revenues and operating income increased, reflecting growth across channels for the Dockers® brand, and the acquisition of Beyond Yoga®, which had net revenues of approximately $26 million.

Cash Flow and Balance Sheet

• Cash and cash equivalents at the end of the first quarter of fiscal 2022 of $678 million and short-term investments of $99 million were complemented by $837 million available under the company's revolving credit facility, resulting in a total liquidity position of approximately $1.6 billion.

• Net debt at the end of the first quarter of fiscal 2022 was $248 million. The company’s leverage ratio was 1.1 at the end of the first quarter of fiscal 2022, as compared to 6.8 at the end of the first quarter of fiscal 2021.

• Cash from operations for the first three months of fiscal 2022 increased to $86 million as compared to $69 million for the first three months of fiscal 2021. The increase in cash provided by operating activities was primarily driven by higher collections of trade receivables, partially offset by higher spending on inventory and SG&A expenses, reflective of the increase in sales in comparison to the same period in prior year.

• Adjusted free cash flow for the first three months of fiscal 2022 was negative $124 million, a decrease of $115 million compared to the first three months of fiscal 2021, primarily reflecting higher repurchases of common stock, higher capital expenditures, and higher dividends, partially offset by higher cash from operations.

• Total inventories increased 20% compared to the end of the corresponding prior-year period as the company builds core inventory through the first half of the year to mitigate supply chain risk and capture consumer demand.

• The company declared a dividend of $0.10 per share totaling approximately $40 million, payable in cash on or after May 24, 2022 to the holders of record of Class A common stock and Class B common stock at the close of business on May 6, 2022.

• During the three months ended February 27, 2022, 3 million shares were repurchased. Subsequent to quarter end, the Company completed its $200 million share repurchase program by repurchasing an additional 2 million shares for $40 million. Additional information regarding net debt, leverage ratio, and Adjusted free cash flow, all of which are non- GAAP financial measures, is provided at the end of this press release. Guidance The company reaffirms expectations for fiscal 2022 and are as follows:

• Net revenues growth of 11% to 13% compared to FY 2021, between $6.4 billion and $6.5 billion.

• Adjusted diluted EPS of $1.50-to-$1.56. ?The company plans to share additional details during its investor conference call. The company's outlook assumes no significant worsening of the COVID-19 pandemic, inflationary pressures or dramatic incremental closure of global economies.

Investor Conference Call The company’s first-quarter 2022 investor conference call will be available through a live audio webcast at https://edge.media-server.com/mmc/p/y4c6jge4 on April 6, 2022, at 2 p.m. Pacific Time / 5 p.m. Eastern Time or via the following phone numbers: +1.833.693.0541 in the United States and Canada or +1.661.407.1582 internationally; I.D. No. 7585107. A replay is available the same date on http://investors.levistrauss.com and will be archived for one quarter. A telephone replay is also available through April 13, 2022, via the following phone numbers: +1.855.859.2056 in the United States and Canada or +1.404.537.3406 internationally; I.D. No. 7585107. Please see http://www.levistrauss.com/investors/earnings-webcast for a discussion and reconciliation of non- GAAP measures referenced on the investor conference call.

https://www.levistrauss.com/wp-content/uploads/2022/04/Exhibit-99.1-1Q-2022-Press-Release_FINAL.pdf