#Spinning

Oerlikon 2020 full-year results

Resilient performance in challenging COVID-driven environment;

First Sustainability Report published;

Ordinary dividend payout of CHF [0.35] per share

- • Resilient Group 2020 performance in highly challenging end markets due to COVID-19; Manmade Fibers delivered stable results; Surface Solutions top line impacted by pandemic-weakened end markets; swiftly executed cost-out actions position company for the future.

- • First Sustainability Report underlines Oerlikon’s sustainability credentials and commitment to ESG.

- • Board will propose an ordinary dividend of CHF 0.35 per share at the AGM.

- • Outlook for 2021: Group sales between CHF 2.35–2.45 billion and operational EBITDA margin of 15.5–16.0%.

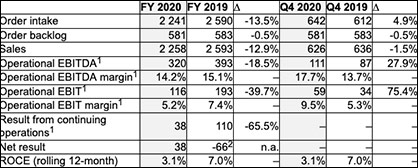

Key Figures of the Oerlikon Group as of December 31, 2020 (in CHF Million)

“Surface Solutions was heavily impacted by COVID-19, but our swiftly executed cost-out actions protected and improved our profitability in the second half of the year and position us for the future. For Manmade Fibers, we maintained our 2019 top line at around CHF 1.1 billion despite challenges posed by the pandemic,” added Dr. Fischer. “Based on our resilient 2020 performance, the Board will propose at the AGM a dividend payout of CHF 0.35 per share.”

“Today marks another key milestone as we publish our first Sustainability Report,” said Dr. Fischer. “Sustainability has always been an integral part of Oerlikon. Helping our customers in key industries achieve more with less is an intrinsic part of our value proposition, our technologies and operations. Our report details our contributions and signifies our commitment to further contribute to the environmental, social and governance goals that are material to our stakeholders.

“Assuming markets remain stable, and there are no further significant disruptions from COVID-19, we expect Group sales to be between CHF 2.35 billion to CHF 2.45 billion and a 15.5% to 16.0% operational EBITDA margin in 2021,” concluded Dr. Fischer.

Resilient Group Performance in Highly Challenging Market Environment

Oerlikon delivered resilient results in an extraordinarily challenging year. While the Manmade Fibers Division delivered stable results, the Surface Solutions Division felt the impacts of pandemic-weakened end markets, particularly in the aerospace sector.

In 2020, Group order intake, including a 4.9% adverse currency impact, was CHF 2 241 million. Compared to the previous year, order intake decreased by 13.5% from CHF 2 590 million. Order backlog slightly decreased by 0.5% to CHF 581 million at year-end 2020 versus CHF 583 million at year-end 2019. Group sales were 12.9% lower in 2020 at CHF 2 258 million compared to CHF 2 593 million in 2019. At constant exchange rates, sales were at CHF 2 371 million.

In 2020, the Surface Solutions Division generated 53% of Group sales and 55% of Group operational EBITDA, while the Manmade Fibers Division accounted for 47% of Group sales and 47% of Group operational EBITDA.

Oerlikon saw sales growth in China, attributed to the manmade fibers business, while sales declined in the other regions. Asia-Pacific continued to account for the largest proportion of Group sales in 2020. Sales in Asia-Pacific slightly increased to CHF 1 208 million, or 53% of Group sales, versus CHF 1 203 million, or 46% of Group sales, in 2019. Europe was the second-largest regional contributor to Group sales in 2020, with sales totaling CHF 716 million, or 32% of sales, compared with CHF 897 million, or 35% of sales, in 2019. Group sales in North America totaled CHF 271 million, or 12% of Group sales, in 2020, versus CHF 394 million, or 15% of Group sales, in 2019. Sales in other regions decreased to 3% of Group sales in 2020 with sales of CHF 62 million, compared to CHF 99 million in 2019. The Group generated 35% of its revenue from services in 2020 (2019: 38%).

Successfully Executed Cost-Out Actions Protected Operating Profitability

The Oerlikon Group income from continuing operations in 2020 was CHF 38 million, compared with CHF 110 million in 2019, a decrease of 65.5%. As there were no effects from discontinued operations in 2020, net profit amounted to CHF 38 million in 2020, or earnings per share of CHF 0.11, versus CHF -66 million, or earnings per share of CHF -0.21, in 2019. The tax expense for 2020 was CHF 22 million, while in 2019, it was CHF 39 million.

As of December 31, 2020, Oerlikon had total assets of CHF 3 340 million, compared to CHF 3 647 million at year-end 2019. The Oerlikon Group had equity (attributable to shareholders of the parent) of CHF 1 324 million, representing an equity ratio of 40%.

Continued Strong Commitment to R&D

In 2020, Oerlikon strengthened its innovation pipeline by filing 98 patents. The company continued to invest in innovation and spent 5.2% (CHF 118 million) of 2020 Group sales on R&D to develop new, improved and sustainable technologies to meet customers’ needs and demands.

Q4 2020: Strong Operating Profitability, Driven by High Year-End Demand

Order intake increased 4.9% year-on-year to CHF 642 million (Q4 2019: CHF 612 million). Group sales were 1.5% lower at CHF 626 million (Q4 2019: CHF 636 million).

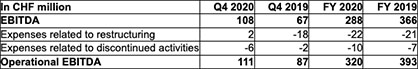

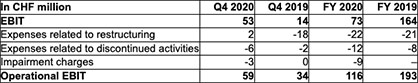

Group operational EBITDA improved by 27.9% to CHF 111 million, or 17.7% of sales (Q4 2019: CHF 87 million, or 13.7% of sales). Q4 2020 Group operational EBIT was CHF 59 million, or 9.5% of sales (Q4 2019: CHF 34 million, or 5.3% of sales). The operational margin improvements are attributed to cost actions and to the higher demand for equipment toward the end of the year. Group Q4 unadjusted EBITDA was CHF 108 million, or 17.2% of sales (2019: CHF 67 million; 10.5%), and unadjusted EBIT was CHF 53 million, or 8.5% of sales (2019: CHF 14 million; 2.2%)

Group operational EBITDA margin was 14.2%, which was only 0.9% points lower than the 15.1% in 2019, underlining the impacts of cost-out actions. Operational EBITDA was CHF 320 million, compared to CHF 393 million in 2019. Operational EBIT margin was 5.2% (CHF 116 million), compared to 7.4% (CHF 193 million) in the previous year.

Group unadjusted EBITDA decreased 21.3% to CHF 288 million, or 12.7% of sales, while Group unadjusted EBIT was CHF 73 million, or 3.2% of sales. In 2019, unadjusted Group EBITDA was CHF 366 million, or 14.1% of sales, and EBIT was CHF 164 million, or 6.3% of sales. The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Table I: Reconciliation of Q4 2020 and FY 2020 Operational EBITDA and EBITDA(1)

Table II: Reconciliation of Q4 2020 and FY 2020 Operational EBIT and EBIT(1)

The Oerlikon Group income from continuing operations in 2020 was CHF 38 million, compared with CHF 110 million in 2019, a decrease of 65.5%. As there were no effects from discontinued operations in 2020, net profit amounted to CHF 38 million in 2020, or earnings per share of CHF 0.11, versus CHF -66 million, or earnings per share of CHF -0.21, in 2019. The tax expense for 2020 was CHF 22 million, while in 2019, it was CHF 39 million.

As of December 31, 2020, Oerlikon had total assets of CHF 3 340 million, compared to CHF 3 647 million at year-end 2019. The Oerlikon Group had equity (attributable to shareholders of the parent) of CHF 1 324 million, representing an equity ratio of 40%.

Continued Strong Commitment to R&D

In 2020, Oerlikon strengthened its innovation pipeline by filing 98 patents. The company continued to invest in innovation and spent 5.2% (CHF 118 million) of 2020 Group sales on R&D to develop new, improved and sustainable technologies to meet customers’ needs and demands

Q4 2020: Strong Operating Profitability, Driven by High Year-End Demand

Order intake increased 4.9% year-on-year to CHF 642 million (Q4 2019: CHF 612 million). Group sales were 1.5% lower at CHF 626 million (Q4 2019: CHF 636 million).

Group operational EBITDA improved by 27.9% to CHF 111 million, or 17.7% of sales (Q4 2019: CHF 87 million, or 13.7% of sales). Q4 2020 Group operational EBIT was CHF 59 million, or 9.5% of sales (Q4 2019: CHF 34 million, or 5.3% of sales). The operational margin improvements are attributed to cost actions and to the higher demand for equipment toward the end of the year. Group Q4 unadjusted EBITDA was CHF 108 million, or 17.2% of sales (2019: CHF 67 million; 10.5%), and unadjusted EBIT was CHF 53 million, or 8.5% of sales (2019: CHF 14 million; 2.2%)

First Sustainability Report

Sustainable innovation is an integral part of Oerlikon’s strategy and built into everything the company does. Oerlikon is now making a public commitment and publishing its first Sustainability Report. It is joining the ranks of corporations, people and organizations that proactively engage in sustainability and inspire others to do the same. Based on the materiality analysis, Oerlikon has selected 8 out of the 17 United Nations Sustainable Development Goals (SDGs) where the company can make the most difference for its stakeholders. Environmental, social and governance targets for 2030 have been set by the Group in areas that align most closely with its operations, policies and capabilities. For further details, refer to www.sustainability.oerlikon.com.

Board Member Change

Current Board member, Geoffery Merszei, who has served on the Oerlikon Board of Directors since 2017, has decided not to stand for reelection. The Board of Directors thanks him for his valuable contributions to Oerlikon. The Board is proposing Jürg Fedier as a new nominee to the Board for election at the 2021 Annual General Meeting of Shareholders (AGM) on April 13, 2021. All other Board members will be standing for reelection at the AGM.

Jürg Fedier (1955, Swiss citizen) was Chief Financial Officer of the Oerlikon Group from January 2009 to December 2019. From 2007 to 2008, he acted as CFO of Ciba, Switzerland. Prior to that, Jürg Fedier held senior financial management position at Dow Chemical for 30 years, the latest as Head of Finance of Dow Europe and a member of its Executive Board. Jürg Fedier holds a Commercial Diploma from the College of Commerce in Zurich, Switzerland, and completed international executive management programs at IMD, Lausanne, Switzerland, and the University of Michigan, USA.

Dividends

Oerlikon is committed to providing attractive returns to shareholders while maintaining financial flexibility to invest in growth. In line with this strategy, the Board will recommend to shareholders to maintain an ordinary dividend payout as in the previous three years of CHF 0.35 per share at the Annual General Meeting of Shareholders (AGM) on April 13, 2021, in Pfäffikon, Switzerland.

Outlook: Structural Programs to Improve Mid-Term Margins

The structural programs implemented in 2020 are expected to support mid- and long-term improvement in operating profitability and drive the Group’s EBITDA margin toward 16% to 18%. Assuming the

COVID-19 pandemic does not cause further major disruptions and markets continue to improve as vaccination programs are successful, Oerlikon expects sales of CHF 2.35 billion to CHF 2.45 billion and operational EBITDA margin of 15.5% to 16.0% in 2021.

Division Overview

Surface Solutions Division

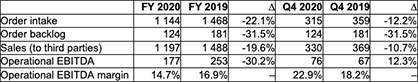

Key Figures of the Surface Solutions Division as of December 31, 2020 (in CHF Million)

Surface Solutions was impacted by market weakness intensified by the pandemic. Effective cost-out programs were successfully executed and helped to protect operating profitability. Market recovery was noted in automotive and tooling in the second half of the year, while aerospace faced prolonged pandemic-induced weakness.

Orders for the Division were CHF 1 144 million, down 22.1% from the prior year’s CHF 1 468 million. Division sales at CHF 1 197 million, down 19.6% from the CHF 1 488 million in 2019. At constant exchange rates, Division sales were CHF 1 261 million.

Operational EBITDA was CHF 177 million, or 14.7% of sales, compared to CHF 253 million, or 16.9% of sales in 2019. Sequentially, the operational EBITDA margin improved, reflecting the positive impacts of the restructuring programs. The structural components of the program are expected to yield mid- to long-term improvements in the Division’s operating profitability. Unadjusted EBITDA was CHF 144 million, or 12.0% of sales, compared to CHF 234 million, or 15.6% of sales in 2019. Operational EBIT in 2020 was CHF 10 million in 2020, or 0.9% of sales (2019: CHF 86 million, or 5.8% of sales), and unadjusted EBIT was CHF -32 million, or -2.7% of sales (2019: CHF 65 million, or 4.4% of sales).

Toward the end of 2020, the Division acquired the thermal insulation systems business from Crosslink GmbH, Germany, to add thermal insulation material solutions to the portfolio to further strengthen the participation in the growing market for battery electric vehicles.

Manmade Fibers Division

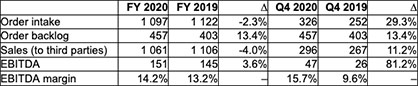

Key Figures of the Manmade Fibers Division as of December 31, 2020 (in CHF Million)

The Division delivered a strong performance in 2020 despite the pandemic. After securing record wins for filament equipment at the beginning of 2020 (total value of more than CHF 600 million), the Division proved to be highly resilient for the remainder of the year, even after the outbreak of COVID-19. The nonwoven business benefited from the unanticipated surge in demand for protective wear and masks. Sales and orders for manmade fibers systems both exceeded CHF 1 billion for the year, and the Division has full order books for filaments and nonwovens equipment for the next two years and the books are being filled into 2023.

Year-over-year, order intake decreased slightly by 2.3% to CHF 1 097 million compared to CHF 1 122 million in 2019. Sales also decreased slightly by 4.0% to CHF 1 061 million, compared to CHF 1 106 million in 2019. At constant exchange rates, sales were CHF 1 110 million.

The Division delivered stable double-digit profitability. Operational EBITDA improved year-over-year to CHF 151 million, or 14.2% of sales, compared to CHF 145 million, or 13.2% of sales, in 2019. Unadjusted EBITDA was CHF 150 million, or 14.1% of sales (2019: CHF 144 million, 13.0%). Operational EBIT for 2020 was CHF 120 million (2019: CHF 119 million), or 11.3% of sales (2019: 10.8%). Unadjusted EBIT was CHF 118 million (2019: CHF 117 million), or 11.2% of sales (2019:10.6%).

In the first quarter of 2020, the Manmade Fibers Division took over the majority stake in the joint venture Teknoweb Materials S.r.l. to extend the nonwoven production system portfolio for disposable nonwovens. This move strengthened the Division’s position in the nonwoven market.