#Retail & Brands

adidas reports strong Q2 growth with double-digit sales increase

Key Financial Highlights

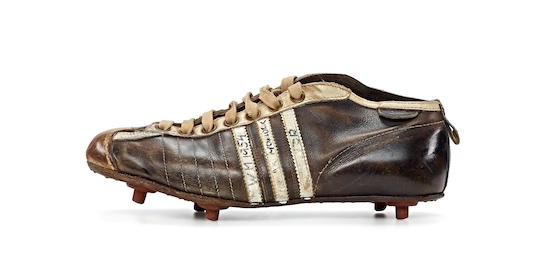

Revenue Growth: Currency-neutral revenues surged by 11%, with the Adidas brand itself growing by 16%. Footwear sales led the charge, increasing by 17%, supported by strong performances in Originals and Football categories.

Profitability: Operating profit nearly doubled, reaching €346 million compared to €176 million in the same period last year. The underlying gross margin improved by approximately 1.5 percentage points, reaching 50.5%, despite significant currency challenges.

Inventory and Market Performance: Inventories remained healthy at €4.5 billion, supporting future growth. European, Emerging Markets, and Latin American sales experienced strong double-digit growth, with increases of 19%, 25%, and 33%, respectively.

CEO Remarks

Adidas CEO Bjørn Gulden expressed optimism about the company's trajectory, stating, "Q2 was another quarter confirming that we are improving and on the way to again becoming a good and healthy company. Consumers are reacting positively to both our marketing and product launches."

Gulden highlighted the positive consumer sentiment and the success of Adidas' marketing efforts, which have driven increased interest in both lifestyle and performance products. The recent Euro and Copa football events were also noted for boosting brand visibility, with Adidas teams Spain and Argentina winning their respective tournaments.

SECOND-QUARTER RESULTS

Currency-neutral revenue growth accelerates to double-digit rate in the second quarter

In the second quarter of 2024, currency-neutral revenues increased 11% compared to the prior year. The double-digit growth reflects the strong momentum of the underlying adidas business, which grew 16%. The sale of parts of the remaining Yeezy inventory generated revenues of around € 200 million in the quarter, which is significantly below the Yeezy sales generated in the prior year (2023: around € 400 million in Q2). In euro terms, revenues grew 9% to € 5.822 billion (2023: € 5.343 billion) as currency developments led to an unfavorable translation impact.

Footwear continues to lead top-line growth with strong product offering

Footwear revenues increased 17% on a currency-neutral basis during the quarter. The strong product offering in Originals and Football translated into strong double-digit growth in those categories. In addition, increases in Running, Training, Performance Basketball, and Sportswear also contributed to the top-line increase in footwear. Apparel sales were up 6% in Q2, driven by strong double-digit growth in Football. Jersey sales related to the UEFA EURO 2024 and the CONMEBOL Copa América, with the adidas teams Spain and Argentina winning the tournaments, drove the increase. Elsewhere, improving momentum in apparel was still offset by a relatively conservative sell-in approach, particularly in North America. Accessories declined 8% during the quarter.

Double-digit increases in Lifestyle and Performance

On a currency-neutral basis, Lifestyle revenues increased double digits during the quarter. The company continued to drive newness and depth across its popular Samba, Gazelle, Spezial, and Campus products. In addition, adidas also experienced increasing demand in Retro Running. By launching further franchises in Sportswear, the company started to serve consumer needs across a wider range of price points. Collaborations with partners such as JJJJound, Edison Chen, Wales Bonner, Bad Bunny or Xochitl Gomez continued to fuel demand for the company’s overall Lifestyle offering. Performance also posted double-digit growth, led by Football. In addition to the successful jersey sales, the company recorded a strong uptake of its footwear franchises. The latest iterations of Predator and Copa, as well as the newly launched F50 franchise, benefited strongly from their on-pitch visibility during the two major football events. Growth also accelerated in other major Performance categories. In Running, adidas continued to benefit from strong demand for its record-breaking Adizero family and started to tap into the broader market with its new Supernova and Adistar franchises. In addition, the successful launch of the Dropset 3 drove growth in Training. In Performance Basketball, Anthony Edwards’ AE 1, the Harden Vol. 8, and Donovan Mitchell’s D.O.N. Issue 6 experienced strong sell-throughs and drove brand awareness.

Double-digit growth in wholesale and own retail

From a channel perspective, the underlying top-line momentum has broadened during the second quarter. Wholesale grew 17% on a currency-neutral basis. Direct-to-consumer (DTC) revenues grew 4% versus the prior year. Excluding Yeezy, the company’s DTC business grew 21%. Within DTC, growth in adidas’ own retail stores further accelerated (+15%) driven by strong sell-out in the company’s concept store fleet. E?commerce revenues declined 6% in the quarter because of the significantly smaller Yeezy business. Excluding Yeezy, revenues in e-commerce were up more than 30% in Q2.

Strong double-digit growth in Europe, Emerging Markets, and Latin America

Currency-neutral sales in Europe increased 19% during the quarter, while revenues in Emerging Markets and Latin America also grew double digits (+25% and +33%, respectively). Sales in Greater China grew 9% and revenues in Japan/South Korea were up 6%. Revenues in North America decreased 8%. The decline was solely related to the significantly smaller Yeezy business. Excluding Yeezy, revenues in North America increased versus the prior year driven by growth in both wholesale and own retail.

Underlying gross margin improves around 1.5 percentage points

The company’s second quarter gross margin reached a level of 50.8% (2023: 50.9%). The significantly smaller Yeezy business had a negative impact on the year-over-year comparison. Excluding Yeezy, the adidas gross margin increased around 1.5 percentage points to a level of around 50.5% during the quarter (2023: around 49.0%), despite negative currency effects still weighing strongly on the development. The underlying improvement reflects better sell-throughs, lower freight and product costs, reduced discounting, and a more favorable product mix.

Moderate increase in expenses amid continued brand investments

Other operating expenses increased by 2% to € 2.637 billion (2023: € 2.582 billion). As a percentage of sales, other operating expenses decreased 3.0 percentage points to 45.3% (2023: 48.3%). Marketing and point-of-sales expenses were up 15% to € 707 million in the quarter (2023: € 617 million). The increase reflects continued investments into the global brand campaign ‘You Got This,’ large-scale activations around major sports events such as the Euro 2024 and Copa América, as well as new product launches. As a percentage of sales, marketing and point-of-sale expenses were up 0.6 percentage points to 12.1% (2023: 11.5%). Operating overhead expenses decreased 2% to € 1.930 billion (2023: € 1.965 billion), despite ongoing investments aimed at strengthening the company’s sales activities. The decline was supported by non-recurring expenses recorded in the prior-year period, which related to accruals for donations and strategic measures. As a percentage of sales, operating overhead expenses decreased 3.6 percentage points to 33.2% (2023: 36.8%).

Operating profit almost doubles to € 346 million

The company’s operating profit amounted to € 346 million (2023: € 176 million), reflecting an operating margin of 5.9% (2023: 3.3%). The sale of parts of the remaining Yeezy inventory contributed around € 50 million to the company’s operating profit in the second quarter. This compares to a profit contribution from Yeezy of around € 150 million in the prior-year period.

Net income from continuing operations increases to € 211 million

Net financial expenses amounted to € 42 million (2023: € 53 million) and the company recorded income taxes of € 93 million (2023: € 27 million). While the tax rate of 30.5% (2023: 21.9%) reflects the normalization of profitability levels, the year-over-year comparison is still impacted by the exceptional pre-tax income developments in the prior year. The company’s net income from continuing operations amounted to € 211 million (2023: € 96 million), while basic EPS from continuing operations increased to € 1.09 (2023: € 0.48).

HALF-YEAR RESULTS

Currency-neutral revenues up 10% in the first half of the year

In the first half of 2024, currency-neutral revenues increased 10% compared to the prior-year period. In euro terms, revenues were up 6% to € 11.280 billion in the first six months of 2024 (2023: € 10.617 billion) as currency developments led to an unfavorable translation impact. The top-line development was driven by the strong momentum of the underlying adidas business, which grew 10% on a currency-neutral basis in the first six months of 2024. In addition, the sale of parts of the remaining Yeezy inventory contributed revenues of more than € 350 million in total during the six-month period (2023: around € 400 million in H1).

Gross margin improves significantly to 51.0%

The company’s gross margin increased 3.2 percentage points to 51.0% (2023: 47.9%) during the first half of the year. The positive development was driven by lower sourcing costs, adidas’ much healthier inventory levels, a more favorable business mix, and reduced discounting. In contrast, negative currency effects weighed significantly on the gross margin.

Operating profit increases to € 682 million

Other operating expenses increased by 3% to € 5.115 billion (2023: € 4.949 billion) in the first six months of 2024. As a percentage of sales, other operating expenses decreased 1.3 percentage points to 45.4% (2023: 46.6%). Marketing and point-of-sale expenses were up 12% to € 1.363 billion (2023: € 1.218 billion) in the first half of the year, reflecting continued brand investments. As a percentage of sales, marketing and point-of-sale expenses were up 0.6 percentage points to 12.1% (2023: 11.5%). Operating overhead expenses slightly increased 1% to € 3.752 billion (2023: € 3.731 billion). As a percentage of sales, operating overhead expenses decreased 1.9 percentage points to 33.3% (2023: 35.1%). As a result, the company’s operating profit amounted to € 682 million (2023: € 236 million), reflecting an operating margin of 6.0% (2023: 2.2%). The sale of parts of the remaining Yeezy inventory contributed around € 100 million to the company’s operating profit in the first half of 2024 (2023: around € 150 million in H1). Net income from continuing operations increased significantly to € 382 million (2023: € 73 million), while basic and diluted earnings per share from continuing operations increased to € 2.05 (2023: € 0.29).

Healthy inventories to support future top-line growth

Inventories decreased 18% to € 4.544 billion as at June 30, 2024. This reflects a reduction of € 1.0 billion compared to the prior-year level of € 5.540 billion due to effective inventory management and represents a healthy foundation to support future top-line growth. On a currency-neutral basis, inventories decreased 17% compared to June 30, 2023. Operating working capital was down 19% to € 4.756 billion (2023: € 5.896 billion). On a currency-neutral basis, operating working capital decreased 18%. Average operating working capital as a percentage of sales decreased 5.3 percentage points to 21.7% (2023: 27.1%). This development mainly reflects the significant decrease of inventories, as an increase in payables was mostly offset by higher receivables.

Adjusted net borrowings decrease € 1.3 billion compared to the prior year

Adjusted net borrowings on June 30, 2024, amounted to € 4.751 billion (June 30, 2023: € 6.039 billion), representing a year-over-year decrease of 21% or € 1.3 billion in absolute terms. This development mainly reflects a decline in short- and long-term borrowings and an increase of cash and cash equivalents.

FULL-YEAR OUTLOOK

High-single-digit revenue increase expected in 2024

On July 16, adidas raised its top- and bottom-line guidance as a result of the better-than-expected performance during the second quarter and taking into account the current brand momentum. adidas now expects currency-neutral revenues to increase at a high-single-digit rate in 2024 (previously: to increase at a mid- to high-single-digit rate). The company’s operating profit is now expected to reach a level of around € 1.0 billion (previously: to reach a level of around € 700 million). Within this guidance, adidas assumes the sale of the remaining Yeezy inventory during the remainder of the year to occur on average at cost. This would result in additional revenues of around € 150 million and no further profit contribution during the second half of 2024.

Outlook impacted by significant currency headwinds

The company continues to expect unfavorable currency effects to weigh significantly on its profitability this year. These effects are negatively impacting both reported revenues and the gross margin development in 2024. This was particularly the case during the first half of the year.