#Nonwovens / Technical Textiles

Berry Global Group reports third fiscal quarter 2022 results

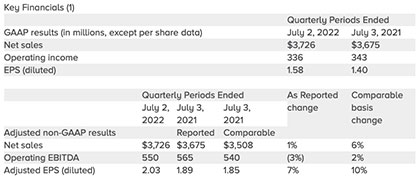

Third Fiscal Quarter Highlights

(all comparisons made to the June 2021 quarter)

- Net sales of $3.7 billion, up 6% on comparable basis

- Operating income of $336 million; Operating EBITDA of $550 million, up 2% on comparable basis

- Earnings per share of $1.58; Adj. earnings per share of $2.03, up 10% on comparable basis

- $637 million of share repurchases year-to-date, an 8% reduction in total shares outstanding

- Fiscal 2022 adjusted earnings per share target of $7.40 and free cash flow target of $750 million

Berry’s Chairman and CEO Tom Salmon said, “For the third fiscal quarter, we reported solid quarterly results including record revenues for any June quarter in our history as underlying demand for our products remained resilient. As we continue to navigate the current environment, we remain focused on cost productivity and working collaboratively with our customers to increase prices to offset rising costs. Adjusted earnings per share came in better than our expectation and was a quarterly record for any period in our history, increasing by 10% versus the prior year on a comparable basis. Furthermore, we continued to increase cash returned to shareholders as we repurchased an additional $286 million of shares, or 4% of our total shares outstanding, in the quarter.

“Our consistent and dependable free cash flow, accompanied by our large-scale and diverse portfolio, provides a resilient and steady business through any economic cycle. Additionally, we continue to prudently invest in each of our businesses to maintain and grow our world-class, low-cost manufacturing base, with an emphasis on organic growth and key growth markets and regions. The continued positive momentum from our investments in areas such as health and wellness, personal care, and food safety drive our business toward more sustainable packaging solutions and provide us with a path to deliver long-term, consistent, volume and earnings growth.”

June 2022 Quarter Results

(1) Adjusted non-GAAP results excludes items not considered to be ongoing operations. In addition, comparable basis change excludes the impacts of foreign currency and recent divestitures. Further details related to non-GAAP measures and reconciliations can be found under our “Non-GAAP Financial Measures and Estimates” section or in reconciliation tables in this release.

Consolidated Overview

The net sales growth is primarily attributed to increased selling prices of $301 million due to the pass through of inflation. On a two-year basis, organic volumes were up 3%, as we reported strong organic volume growth of 5% a year ago, compared to a 2% decline in the quarter. The volume decline is primarily attributed to general market softness in industrial markets and the moderation of advantaged products related to the easing of the COVID-19 pandemic. Net sales were also impacted by a $151 million unfavorable impact from foreign currency changes and prior year quarter divestiture sales of $16 million.

The operating income decrease is primarily attributed to a $22 million unfavorable impact from foreign currency, and an $11 million unfavorable impact from the volume decline, partially offset by a $28 million favorable impact from price cost spread and product mix.

Consumer Packaging - International

The net sales growth in the Consumer Packaging International segment is primarily attributed to increased selling prices of $138 million due to the pass through of inflation, partially offset by a $99 million unfavorable impact from foreign currency changes, an organic volume decline of 2%, and prior year quarter divestiture sales of $16 million. The volume decline is primarily attributed to market softness in industrial markets.

The operating income increase is primarily attributed to a $15 million favorable impact from price cost spread and productivity, and a decrease in depreciation and amortization expense, partially offset by a $15 million unfavorable impact from foreign currency changes.

Consumer Packaging - North America

The net sales growth in the Consumer Packaging North America segment is primarily attributed to increased selling prices of $80 million due to the pass through of inflation.

The operating income increase is primarily attributed to a $30 million favorable impact from price cost spread.

Health, Hygiene, & Specialties

The net sales decline in the Health, Hygiene & Specialties segment is primarily attributed to a 3% volume decline and a $17 million unfavorable impact from foreign currency changes. The volume decline is primarily attributed to the moderation of advantaged products related to the easing of the COVID-19 pandemic.

The operating income decrease is primarily attributed to a $49 million unfavorable impact from negative product mix, lag in recovering inflation, and an unfavorable impact from foreign currency changes.

Engineered Materials

The net sales growth in the Engineered Materials segment is primarily attributed to increased selling prices of $81 million due to the pass through of inflation, partially offset by a volume decline of 4% and a $35 million unfavorable impact from foreign currency changes. The volume decline is primarily attributed to pivoting the sales mix to higher-value categories and general market softness.

The operating income increase is primarily attributed to a $29 million favorable impact from price cost spread, partially offset by an unfavorable impact from foreign currency changes and the volume decline.

Capital Allocation

Berry repurchased approximately 11 million shares (approximately 8% of outstanding shares) during the three quarters ended July 2, 2022 for a total cost of $637 million. The Company expects to repurchase at least $700 million of shares in fiscal 2022. The Company currently has approximately $400 million remaining on its authorized $1 billion share repurchase program. The share repurchases reflect the continued execution of the Company’s opportunistic capital allocation strategy, which includes funding organic growth projects, share repurchases, debt pay down, divestitures and strategic acquisitions. Additionally, in our fiscal fourth quarter we expect to use a portion of our remaining cash to reduce our leverage and end the year in our targeted long-term range of 3.0 – 3.9x, net debt to adjusted EBITDA.

In line with our focus of driving long-term shareholder value, over the past several years, we have divested several small businesses. As we continue to focus on driving maximum shareholder value and alongside our commitment to drive sustainable organic growth, we will continue to optimize our portfolio and believe we have more opportunities, over the next few years, to further elevate and strengthen our portfolio. Given our consistent and dependable free cash flow along with strategic divestiture opportunities we expect to continue to provide capital back to our shareholders along with lowering our leverage. So far this year we have completed three divestitures delivering proceeds of approximately $150 million.

Outlook for Fiscal Year 2022

Berry is now targeting fiscal 2022 adjusted earnings per share of $7.40. The updated guidance assumes operating EBITDA of $2.15 billion, which we are reaffirming and includes continued inflation recovery offset by foreign currency headwinds from the strengthening of the U.S. dollar. The estimate would be a fiscal year record and our tenth consecutive year of adjusted earnings per share growth. Additionally, we expect low-single digit organic volume growth in our fiscal fourth quarter. The Company is also now targeting free cash flow of $750 million which includes cash flow from operations of $1.5 billion less capital expenditures of $750 million. Our updated cash flow outlook includes a one-time increase in working capital of approximately $150 million due to inflation and from our proactive decision to carry higher inventory levels for our customers to mitigate potential supply chain risks and challenges which continue to impact our business. We expect these higher inventory levels to be temporary and will therefore increase future cash flows as we return to normalized levels as supply chains improve. Therefore, we would continue to expect normalized free cash of $900 million, in future years, as these conditions improve.

Salmon added, “We are pleased with the hard work delivered by our employees around the world, delivering solid quarterly results in the face of persistently higher operating costs and a continuously changing economy. We are committed to recovering inflation and continue to see supply chain improvements along with the onboarding of new business and capital investments. Our guidance for the year includes returning $700 million to shareholders via share repurchases and ending the year in our targeted leverage range of 3.0 to 3.9 times as we have previously communicated. We believe we are well-positioned for continued value creation and returning capital to our shareholders through our dependable and consistent free cash generation along with strategic divestiture opportunities which will allow us additional opportunistic share repurchases and further debt repayment.”

Third Fiscal Quarter 2022 Results

https://www.berryglobal.com/en/news/articles/13996-berry-global-group-inc-reports-third-fiscal-quarte