#Nonwovens / Technical Textiles

Suominen announces record year in both net sales and profitability

"Net sales increased by 11.5% and amounted to EUR 458.9 million (411.4). Sales volumes increased with the pandemic-driven high demand for wipes, while sales prices decreased following lower raw material prices. Our operating profit improved significantly and amounted to EUR 39.5 million (8.1) thanks to higher production and sales volumes, favorable raw material prices, and improved production and raw material efficiency.

We published our new strategy aiming for growth and improved profitability in the beginning of 2020. During the year, we announced three investments supporting our strategy, two in Italy and one in the USA, and a cooperation agreement with the Ahlstrom-Munksjö plant in Ställdalen, Sweden.

The cornerstone of our strategy is sustainability and we are continuously developing our offering accordingly. In 2020, we introduced several new sustainable products to the markets. These nonwovens are made of biodegradable, compostable and renewable plant-based fibers. We also published our sustainability agenda, targets and KPIs during the year. Our agenda focuses on four themes: People and safety, Sustainable nonwovens, Low-impact manufacturing and Corporate citizenship. We have concrete action plans for each theme and are steadily progressing towards our targets.

Our frontrunner status in nonwovens innovation was recognized by Rockline’s, one of our major customers, Supplier Innovation Award 2020, citing our novel sustainable product development. We were also the first nonwovens substrate manufacturer receiving Fine to Flush certification from Water UK with our HYDRASPUN® Royal, which is a dispersible nonwoven material especially designed for moist toilet tissues.

Looking at the year ahead, we see a twofold development. The pandemic has increased consumption of nonwovens in all our markets and the demand is expected to continue on a high level. In the long term, COVID-19 may lead to a sustained increase in the use of nonwovens for cleaning and disinfection products. However, the risks related to the pandemic, such as possible shortages of raw materials, issues linked to logistics as well as potential closures of customers’ or our own plants due to virus infections or authority decisions remain relevant. We have already started to experience exceptional volatility in the cost and availability of raw materials and transportation.

Finally, I would like to highlight the commitment of our personnel during the extraordinary year of 2020 and thank them for their efforts in delivering the record performance. We are in a good position to continue our journey forward in 2021.”

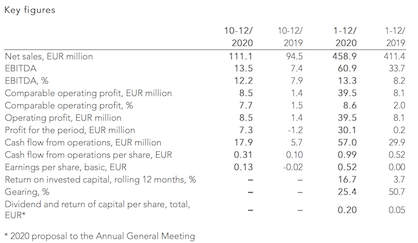

October–December 2020 in brief:

- Net sales increased by 17.6% and were EUR 111.1 million (94.5)

- Operating profit improved significantly to EUR 8.5 million (1.4)

- Cash flow from operations improved to EUR 17.9 million (5.7)

Financial year 2020 in brief:

- Net sales increased by 11.5% and were EUR 458.9 million (411.4)

- Operating profit improved significantly to EUR 39.5 million (8.1)

- Cash flow from operations was strong and totaled to EUR 57.0 million (29.9)

- Board of Directors proposes to the Annual General meeting a dividend of EUR 0.10 per share and in addition to the dividend, a return of capital of EUR 0.10 per share

Outlook:

Suominen expects that its comparable EBITDA (earnings before interest, taxes, depreciation and amortization) in 2021 will be in line with 2020. The demand for nonwovens is expected to remain strong, however the rising volatility in the raw material and transportation markets increases uncertainty and may impact the result negatively. In 2020, Suominen’s comparable EBITDA was EUR 60.9 million.

Board proposal on distribution of dividend:

The Board of Directors proposes to the Annual General meeting, that a dividend of EUR 0.10 per share shall be distributed for the financial year 2020. In addition, the Board of Directors proposes, that in addition to the dividend, a return of capital of EUR 0.10 per share shall be distributed for the financial year 2020 from the reserve for invested unrestricted equity.

On February 3, 2021 the company had 57,568,341 issued shares, excluding treasury shares. With this number of shares, the total amount of dividends to be distributed would be EUR 5,756,834.10 and the total amount of the return of capital would be EUR 5,756,834.10, in total EUR 11,513,668.20.

The Board of Directors of Suominen Corporation resolved on a new share-based Long-Term Incentive Plan for management and key employees

The Board of Directors of Suominen Corporation has resolved on February 3, 2021 on a new share-based Long-Term Incentive Plan for the management and key employees. The aim of the new plan is to combine the objectives of the shareholders and the persons participating in the plan in order to increase the value of the Company in the long-term, to bind the participants to the Company, and to offer them competitive reward plans based on earning and accumulating the Company’s shares.

Performance Share Plan 2021–2023

The new long-term Performance Share Plan has one three-year Performance Period, which includes calendar years 2021–2023. The Performance Share Plan is directed to approximately 20 people including the President & CEO of Suominen.

The Board of Directors resolved that the potential reward for the Performance Period 2021–2023 will be based on the Relative Total Shareholder Return (TSR). The maximum total amount of potential share rewards to be paid on the basis of the Performance Period 2021–2023 is approximately 470,000 shares of Suominen Corporation, representing the gross reward before the deduction of taxes and tax-related costs arising from the reward.

The Board of Directors will be entitled to reduce the rewards agreed in the Performance Share Plan if the limits set by the Board of Directors for the share price are reached.

Reward payment and ownership obligation for the management

If the targets of the Plan are reached, rewards will be paid to participants in spring 2024 after the end of the Performance Period. The potential rewards from the Performance Period 2021–2023 will be paid partly in the Company’s shares and partly in cash. The cash proportion is intended to cover taxes and tax-related costs arising from the reward to the participant. The Company also has the right to pay the reward fully in cash under certain circumstances. As a rule, no reward will be paid, if a participant’s employment or service ends before the reward payment.

A member of the Executive Team must hold 50% of the net number of shares given on the basis of the Plan, as long as his or her shareholding in total corresponds to the value of half of his or her annual gross salary. The President & CEO of the Company must hold 50% of the net number of shares given on the basis of the Plan, as long as his or her shareholding in total corresponds to the value of his or her annual gross salary. Such number of shares must be held as long as the participant’s employment or service in a group company continues.