#Knitting & Hosiery

Mayer & Cie. to shut down after failed search for investor – 270 jobs affected

According to the report, “despite an intensive and international search, no investor could be found, making a structured shutdown of operations unavoidable.” Mayer & Cie. had launched a structured sales process as early as April 2024, later intensifying efforts with additional advisory support in mid-2025. None of the approaches to strategic or financial investors led to a takeover offer.

270 employees to lose their jobs

The shutdown will affect around 270 employees. Most of the workforce will be released from their duties by early February 2026 while the company works through its remaining order backlog. A small team will remain in place afterward to manage the liquidation of assets, including machinery, real estate, and inventories.

Speaking to Schwarzwälder Bote, restructuring expert Martin Mucha of Grub Brugger, who joined the company as general representative, said: “The market for textile machinery has become extremely challenging worldwide. Mayer & Cie. experienced a nearly 50 percent drop in revenue over the past year while costs continued to rise. Despite the most intensive global search, we were unable to find an investor willing to commit to this traditional company. Unfortunately, shutting down operations is now the unavoidable consequence.”

Global pressures and market disruption

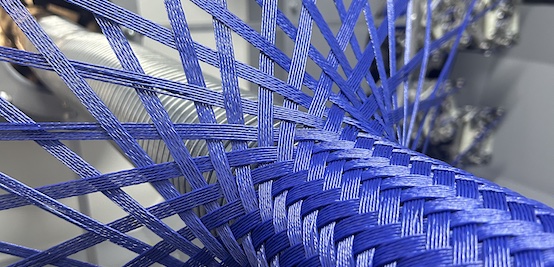

Founded more than 120 years ago, Mayer & Cie. has been a key supplier of circular knitting and braiding machines, exporting almost its entire production worldwide. But the company has been heavily impacted by geopolitical and economic turbulence. As previously reported, trade tensions between the U.S. and China, the war in Ukraine, and inflationary pressure in key textile markets such as Türkiye have led to widespread investment restraint in the textile sector.

In addition, state-subsidized manufacturers from China have intensified competitive pressure by offering machinery at significantly lower prices on the global market.

With no viable option for restructuring and no investor willing to take over the business, the company’s management and insolvency advisors concluded that there is no path to continuation.