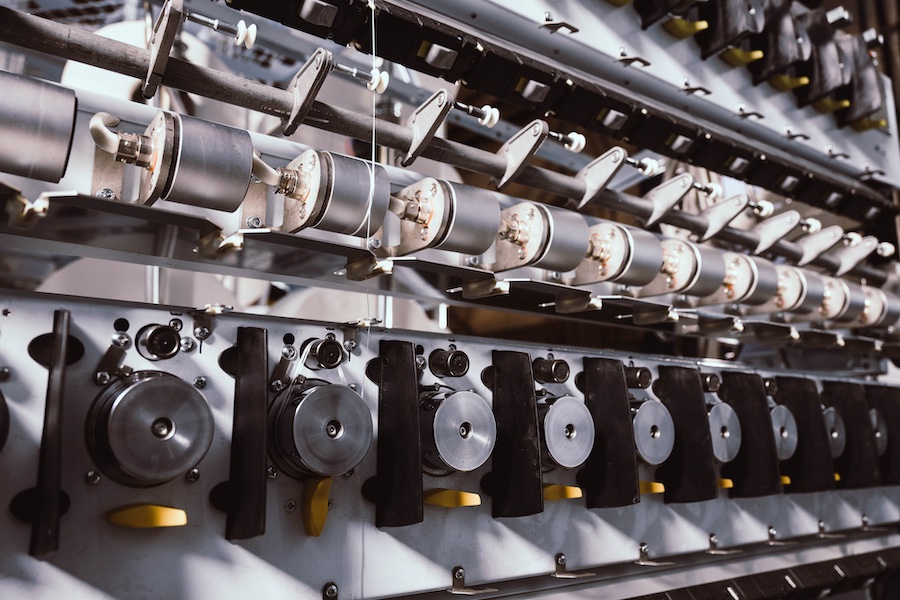

#Spinning

Oerlikon successfully placed CHF 340 million dual-tranche senior unsecured bonds

The coupons have been set at 2.875% per annum for the bonds due 2026 and 3.25% per annum for the bonds due 2029. The coupons for both tranches are payable annually, with the first coupon payable in June 2024 and October 2023 respectively.

An application for the Bonds to be admitted for listing and trading on the SIX Swiss Exchange will be filed, with provisional trading expected to commence on or around May 31, 2023. Settlement date of the Bonds is expected on June 02, 2023.

Commerzbank, Credit Suisse, Bank J. Safra Sarasin, UBS Investment Bank and Zürcher Kantonalbank acted as the Joint Lead Managers and Bookrunners on the offering.