#Software

Black Friday review and forecast - What business strategy will fashion brands adopt?

But is this commercial highpoint in the year truly a business opportunity? What is the game plan for brands? Retviews, a fashion brand data analysis solution acquired by Lectra, has deciphered the special offers proposed in the ready-to-wear sector and particularly the fast fashion segment, to highlight the main lessons to be learned to optimize purchases during this period.

Review of Black Friday promotional strategies

Fashion brands generally schedule targeted sale campaigns during the week of Black Friday and offer an additional one-time savings event the following weekend. Cyber Monday, the last day of discounts offered exclusively online, is an opportunity for brands to add new incentives to stimulate sales on their e-commerce

In 2019, from the Monday to Thursday preceding Black Friday, fashion market players carried out a different promotional campaign daily (similar to Amazon’s Prime Day event).

On Black Friday last year, retailers chose two options: low discounts (20-30%) on their entire collection (the choice of H&M), or higher discounts of 40–50% on a selection of articles (the choice of Zara).

During the weekend that followed, some continued their promotions, relying on an abundance of shoppers.

Mango, for example, offered a 30% discount on its entire collection Friday to Sunday included.

Cyber Monday, which closed this promotional period, allowed certain brands to liquidate part of their inventory by offering customers more interesting online discounts on a selection of items.

Timing – key to success!

While brands prefer not to put their new collection on sale the week of Black Friday, Zara chose a different strategy in 2019 to give itself a head start on the market. The brand implemented a bold marketing campaign, putting its entire new collection online the very next day (Saturday being a high-traffic day in e-commerce).

Market timing is an important part of Inditex’s strategy, as confirmed by its subsidiary Zara, which went as far as to allow its customers to prepare and save their shopping carts a few hours before the savings event was launched.

What is the forecast for Black Friday 2020?

According to FoxIntelligence, in 2019 Black Friday and Cyber Monday generated 167% sales growth. However, trends during the same period in 2020 will logically be affected in Europe by the crisis.

In the current context, a large number of consumers worldwide do not plan to return to stores in the near future. Nevertheless, a positive effect of lockdown on consumption has been an 11% increase in France in e-commerce purchases of clothing and footwear, although spending in brick and mortar stores decreased 26% (Source: Institut français de la mode, September 2020).

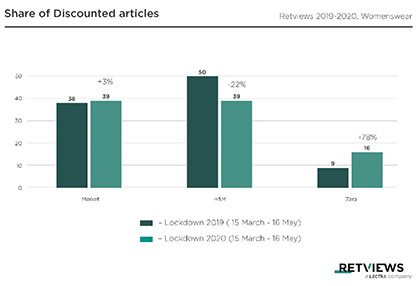

During lockdown in France between mid-March and mid-May 2020, Retviews teams noted a slight increase in the number of discounted items up from 2019 at the same period. As a result, retailers tapped into their promotional budget for that year. This finding could have an impact on whether or not pre-Black Friday and Cyber Monday sales activity is lower in volume in 2020 than it was in 2019.

“The central issue to date is inventory management, on the one hand, and preserving margins on the other,” says Katia Cahen, Marketing Intelligence Director at Lectra. “If a brand has inventory to sell from previous collections, particularly the 2020 spring-summer collection, heavily impacted by lockdown store closures and a relatively weak recovery, it will offer generous deals on certain product categories. If inventories have been more aptly managed, and the fall-winter collection better planned, the brand will run fewer promotional campaigns, with more modest discounts on a limited category of products,” the goal being to safeguard margins on products and categories which are ‘bestsellers’ outside of promotional periods.

Retviews data indicates that Zara is likely to use the same strategy as last year, and that companies like H&M, which did not offer significant discounts during lockdown (22% fewer items were discounted compared to the same period in 2019) should be monitored closely. Brands that have not overspent their annual promotional budget in the spring could very likely offer greater markdowns on Black Friday.

According to Retviews analyses, the sales strategies of ready-to-wear companies on Black Friday are expected to be similar to those of last year. One of the only predicted differences is that brands preferring a significant discount strategy are expected to have a smaller panel of heavily promoted items than in 2019.

As Katia Cahen points out: “H&M, which traditionally has far more immobilized inventory than Zara (a $4 billion inventory challenge, revealed in 2019), will probably be inclined to run more promotions than Zara again this year. This assumption needs to be qualified, however, due to the acceleration of an eco-responsible strategy on the part of the brand to manage its inventory differently and gradually abandon a highly incentivizing sales policy. "