#Retail & Brands

Inditex with good figures for the first 9 months of 2023

Gross profit increased 12.3% to €15.2 billion. The gross margin reached 59.4% (+67 bps versus 9M2022). All expense lines have shown a favourable evolution. Operating expenses increased 10.6%, below sales growth.

/ EBITDA increased 13.9% to €7.4 billion.

/ EBIT increased 24.3% to €5.2 billion and PBT 29.8% to €5.2 billion.

/ Net income increased 32.5% to €4.1 billion.

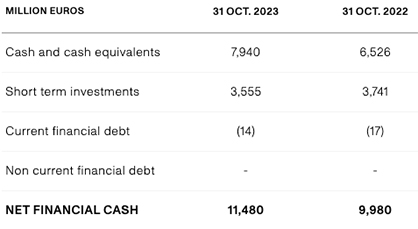

/ Strong cash flow generation. The net cash position grew 15% to €11.5 billion versus the same period last year.

/ The FY2022 final dividend of €0.60 per share was paid on 2 November 2023.

/ AutumnWinter collections continue to be well received by our customers. Store and online sales in constant currency between 1 November and 11 December 2023 increased 14% versus the same period in 2022.

/ Based on current information, in FY2023 Inditex expects a gross margin of around 75 bps higher than in FY2022.

Interim Nine Months 2023: Very strong operating performance

The Autumn/Winter collections have been very well received by customers. Sales grew 11.1% over 9M2022 to reach €25.6 billion, showing very satisfactory development both in stores and online. Sales were positive in all geographical areas and in all concepts. Sales in constant currency grew 14.9%.

In 9M2023, openings have been carried out in 36 markets. At the end of the period Inditex operated 5,722 stores. A list of total stores by concept is included in Annex I.

In 9M2023, the execution of the business model was very strong. Additionally, the Autumn/Winter 2023 season has experienced a normalisation in supply chain conditions and a more favourable Euro/USD exchange rate compared to the same season in 2022. Gross profit increased 12.3% to €15.2 billion. The gross margin reached 59.4% (+67 bps).

All expense lines have shown a favourable evolution. Operating expenses increased 10.6%, below sales growth. Including all lease charges, operating expenses grew 130 bps below sales growth.

EBITDA increased 13.9% to €7.4 billion.

EBIT increased 24.3% to €5.2 billion and PBT 29.8% to €5.2 billion. As a reminder, in 9M2022, Inditex reported a provision for expected expenses for FY2022 in the Russian Federation and Ukraine of €231 million under Other results.

Annex II includes a breakdown of the Financial Results.

The tax rate applied to the 9M2023 results is the best estimate for the fiscal year 2023 based on available information.

Net income increased 32.5% to reach €4.1 billion.

Given the execution of the business model, Inditex generated strong cash flow. The net cash position grew 15% to €11.5 billion at the end of 9M2023 versus the same period last year. Inditex paid €1.9 billion (€0.60 per share) on 2 November 2023 as the final dividend for FY2022.

Due to the robust operating performance over 9M2023 and the normalisation in supply chain conditions, inventory was 5% lower as of 31 October 2023 versus the same date in 2022. Collections are considered to be of high quality.

Start of 4Q2023

The Autumn/Winter collections have been very well received by our customers. Store and online sales in constant currency between 1 November and 11 December 2023 increased 14% versus the same period in 2022.

Outlook

Inditex continues to see strong growth opportunities. Our key priorities are to continually improve the fashion proposition, to enhance the customer experience, to increase our focus on sustainability and to preserve the talent and commitment of our people. Prioritising these areas will drive long-term growth. To take our business model to the next level and extend our differentiation further we are developing several initiatives in all key areas for the coming years.

The creativity of our teams and the flexibility of the business model in conjunction with in-season proximity sourcing allows a swift reaction to customer demand. This situation results in a unique market position which provides our business model with great growth potential going forward.

Inditex operates in 213 markets with low share in a highly fragmented sector and we see strong growth opportunities. We expect increased sales productivity in our stores going forward. The growth of gross space in 2023 will be around 3%. Optimisation of stores is ongoing. Inditex expects space contribution to sales to be positive in 2023. We continue to see a very satisfactory evolution of online sales and an increasing participation in the Group total. At current exchange rates, Inditex expects a -4% currency impact on sales in FY2023.

In the latter part of 2023, the strong execution of the business model and the operating conditions mentioned previously continue. For these reasons and based on current information, in FY2023 Inditex expects a gross margin of around 75 bps higher than in FY2022.

For FY2023, we are making investments that are scaling our capabilities, generating efficiencies, and increasing our competitive differentiation to the next level. We estimate ordinary capital expenditure of around €1.6 billion.

Fashion proposition

We continue focusing on the creativity, innovation, design and quality of all our collections and integrated sales channels, while reinforcing the commercial initiatives of all our concepts. Zara Studio, Zara Fragrances, Zara Home Editions, Massimo Dutti Manhattan, Pull&Bear Partywear, Bershka Teddy Coats, Stradivarius Night and Oysho Recco Ski are just some of the creative proposals available through the Autumn/Winter 2023.

Customer experience

To continue offering the best customer experience both in our stores and on our online platforms we are developing several initiatives:

/ The new store design for Zara created by our Architectural Studio is featured in openings, enlargements or relocations such as Dubai Mall of the Emirates, Rotterdam Coolsingel, Miami Dadeland and Sevilla Plaza del Duque.

/ We continue optimising our store presence with important openings for the concepts, with key examples like Massimo Dutti’s London Battersea, Bershka Milan Corso Vittorio Emanuele and the rollout into new markets, like the first Stradivarius stores in Germany at Stuttgart and Dresden.

/ The hardware for the new security technology in stores to eliminate hard tags is now in operation in Zara stores globally. Test operations started in the 2023 Autumn/Winter season with full implementation by FYE 2024.

/ We have recently launched a new weekly livestream experience on Douyin in China. The livestream runs for five hours and includes catwalks, walkthroughs of the fitting rooms and makeup area, and "behind-the-scenes" views of the camera equipment and staff. The livestream reflects our continual efforts to offer the best customer experience and will be available soon in other markets.

Sustainability

Sustainability is a key part of Inditex’s strategy. The Group is moving towards a more sustainable model, reducing the environmental footprint of products and taking new steps to becoming a company that generates impacts that are more respectful of both people and the planet.

We are making progress in meeting all the objectives set for the period 2023 to 2025. As highlighted at the Annual General Meeting of July 2023, new objectives were announced in the roadmap for the remainder of the decade, on our way to net zero emissions in 2040.

In terms of circularity, we continue the deployment of the Zara Pre-owned platform. On 12 December the platform was launched in 14 European markets: Spain, Portugal, Germany, Austria, Belgium, Luxemburg, The Netherlands, Finland, Ireland, Italy, Greece, Croatia, Slovenia and Slovakia, joining the service offered already in the United Kingdom and France. Zara Pre-Owned provides customers the access to a platform integrated into the Zara website and app to extend the life of their products through donation, repair and resale.

People

Our culture and values are a fundamental part of how we do things at Inditex. To this end, we have more than 165,000 people who bring our culture to life on a daily basis. With our teams in mind, and in line with our commitment to people, we continue to develop initiatives that reinforce our values, in all the markets in which we operate.

In October, we celebrated the 4th edition of Impact Week, reinforcing our commitment to people with disabilities. 20,000 people across all our markets participated in different initiatives. Our target is to recruit people with disabilities in order to reach a minimum of 2% in our global workforce by the end of 2024. This is in line with our commitment to the International Labour Organization following Inditex's accession to the ILO Global Business and Disability Network, announced in January of this year.

Dividends

The FY2022 final dividend of €0.60 per share was paid on 2 November 2023.