Raw Materials

Decreasing production and the critical role of traceability

The decrease in production is largely coming from three countries: the United States (-400,000 tonnes), Pakistan (-100,000 tonnes), and Sudan (-50,000 tonnes). Water shortages and unusually dry weather are the issues for the US and Pakistan, while Sudan's crop damage is the result of pest infestations.

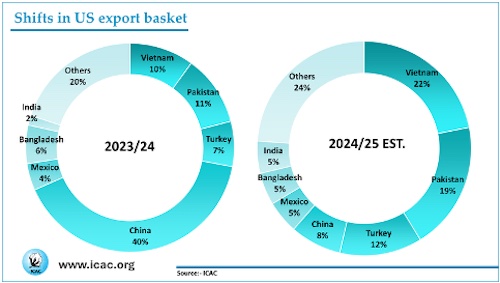

Although consumption and trade numbers are largely unchanged from last month, import and export partners are shifting. China accounted for 40% of US cotton exports in 2023/24, but that number has dropped to 8% as the US has increased its trade with Vietnam, Pakistan, Turkey, and India. Those changes — combined with a US executive order that allows products made from US raw materials to be exempted from import tariffs — mean textile manufacturers must provide traceability. Retailers and brands are increasingly demanding traceability as well.

There are two other notable developments since last month:

+ India’s levels of cotton lint imports increased by nearly 3.3 times in 2024/25 compared to the prior season.

+ Bangladesh and India are expected to increase their US imports.

ICAC data rectification process

The ICAC Secretariat is undertaking data rectification work, during which we will perform data adjustments for all our reported regions and countries. ICAC is the primary source for all of our statistical data. For this month, changes to cotton market variables have been made for Ethiopia from 2014/15 to the present, and the projected season. The data has been updated using information from the Ethiopian Cotton Organization, Ethiopia Revenue and Customs Service, and the Trade Data Monitor.

ICAC’s Statistical Data Portal

For the most current statistics, please refer to the ICAC’s Statistics Portal. It is updated with new data constantly, and that new information is immediately reflected in the Portal, making it a valuable resource all month long.

ICAC’s Price Projections

The Secretariat’s current price forecast for the 2025/26 season, based on current supply and demand estimates, ranges from 60 to 96 cents per pound, with a midpoint of 76 cents per pound. ICAC’s price projections are made by Ms Lorena Ruiz, ICAC Economist.