#Composites

SGL Carbon reports best operating result in more than ten years - transformation successfully completed

- Sales increase of 12.8% to €1,135.9 million

- EBITDApre improves by 23.4% to €172.8 million

- Net financial debt reduced from €206.3 million to €170.8 million

- Fiscal 2023 expected to be investment and stabilization year

Sales in fiscal 2022 increased by 12.8% year-on-year to €1,135.9 million (previous year: €1,007.0 million). The rise in sales was mainly due to both volume effects and the successful implementation of pricing initiatives to compensate higher raw material, energy and transport prices. At 23.4%, adjusted EBITDA (EBITDApre) improved at a higher rate than sales and amounted to €172.8 million in fiscal 2022 (previous year: €140.0 million). Increased sales and the associated higher capacity utilization also contributed to the improvement in earnings, as well as focusing on market segments with higher margin potential.

"We also delivered in 2022. The sales and earnings figures for 2022 confirm the successful transformation of our SGL Carbon. In the last two years, we increased our sales by 23.5% and even improved our EBITDApre by 86.2%. EBITDApre margin in 2022 is 15.2%. As a result, we have almost achieved our medium-term targets for 2025 set in 2020 by the end of 2022. A great success for the entire SGL workforce," says CEO Dr. Torsten Derr.

Earnings development of SGL Carbon

The increase in EBITDApre by €32.8 million to €172.8 million was mainly driven by the Graphite Solutions business unit (+€30.6 million). The Composite Solutions (+€7.9 million) and Process Technology (+€5.2 million) business units also contributed to the improvement in profitability. Although the Carbon Fibers business unit was able to offset the loss of a lucrative supply contract with an automotive customer in terms of sales with new orders from the wind energy sector, but these sales showed a significantly lower margin level. Accordingly, EBITDApre of this business unit decreased by €11.2 million to €43.2 million (previous year: €54.5 million).

Taking into account net one-off effects and non-recurring items of €8.9 million (previous year: €30.7 million) and depreciation and amortization of €60.8 million (previous year: €60.3 million), reported EBIT amounted to €120.9 million (2021: €110.4 million). This corresponds to an increase of 9.5%.

As a result of the pleasing business performance, the successes of the transformation and non-operating one-off effects and non-recurring items (€8.9 million), a positive Group’s net profit of €126.9 million (previous year: €75.4 million) was achieved in 2022. It should be noted that consolidated net income includes tax income of €31.3 million (previous year: minus €6.2 million). This development is mainly due to valuation adjustments on deferred tax assets amounting to €41.8 million, based on the good business development combined with positive earnings prospects in the USA. Current tax expenses amounted to €11.4 million in 2022 (previous year: €11.9 million).

Net financial debt and equity

In fiscal 2022, net financial debt was reduced significantly by 17.2% to €170.8 million compared with the end of 2021 (€206.3 million). The main reason for the decrease is the repayment of financial liabilities in the amount of €29.0 million. Free cash flow decreased from €111.5 million to €67.8 million in 2022. In this context, it should be taken into account that in the previous year, free cash flow included cash inflows of €30.6 million from the sale of land not required for operations.

After 2021, the equity ratio increased again to 38.5% at the end of 2022 (previous year: 27.0% I 2020: 17.5%). Due to the significantly improved earnings situation, the return on capital employed (ROCE) also rose from 8.0% in the previous year to 11.3% in 2022.

"In fiscal year 2022, we further improved SGL Carbon's financial structure. As a result of the reduction in net debt, the leverage ratio at the end of 2022 was 1.0, compared to 1.5 as of December 31, 2021. We are particularly proud of the early refinancing of our convertible bond in September 2022. The fast placement of the new convertible bond in a volatile market environment has shown that investors trust us again. This is also evidenced by the upgrade of Moody's Corporate Family Rating from B3 to B2 at the beginning of this year," explains Thomas Dippold, CFO of SGL Carbon.

Development of the business units

As the largest business unit with a share of Group sales of around 45%, Graphite Solutions contributed €512.2 million to Group sales in 2022 (previous year: €443.6 million). The 15.5% increase in sales is based in particular on the positive development of the important market segments Semiconductor & LED and Industrial Applications. Compared to the previous year, sales to customers in the semiconductor & LED industry increased by 49.6%, driven in particular by increasing demand of materials and components for the production of silicon carbide-based high-performance semiconductors. Combined with the increase in sales, GS EBITDApre improved by 34.8% to €118.5 million (previous year: €87.9 million). Accordingly, the EBITDApre margin increased from 19.8% to 23.1%. Volume effects due to higher sales as well as margin effects from the product and customer mix had a positive impact. Especially the higher sales with customers from the semiconductor industry should be taken into account.

In fiscal 2022, the Process Technology(PT)business unit benefited from the good order situation in recent months and increased its sales by 21.9% to €106.3 million. The main clients of the PT business unit are customers from the chemical industry. The positive development of PT is also reflected in EBITDApre which rose from €4.7 million in the same period of the previous year to €9.9 million. Higher capacity utilization and the successful passing on of increased raw material costs led to an improvement in the EBITDApre margin from 5.4% to 9.3% in 2022. Energy costs play only a minor role at PT.

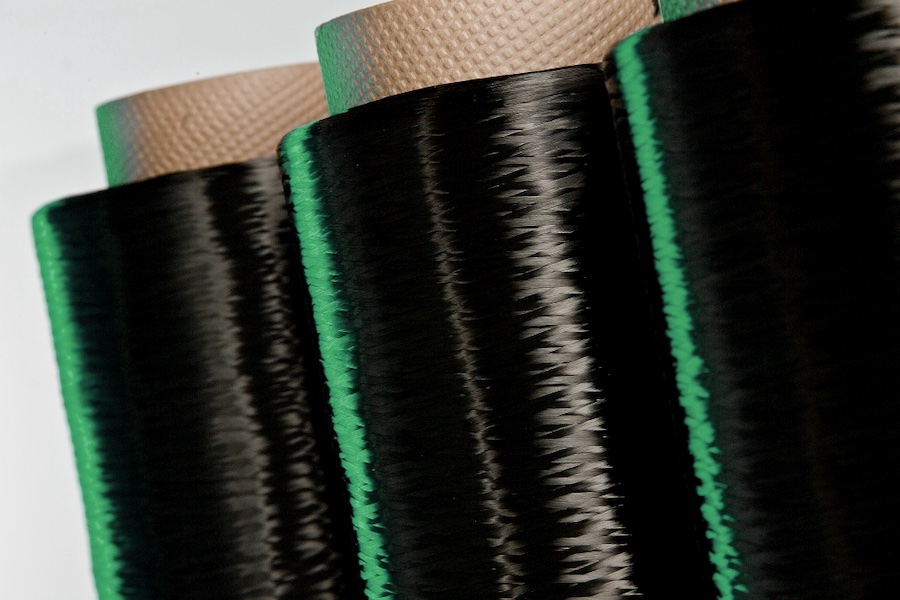

In the reporting year, sales of the Carbon Fibers(CF)business unit increased by 3.0% to €347.2 million (previous year: €337.2 million). It should be noted that CF had to absorb the scheduled expiry of a supply contract with an automotive customer at the end of June 2022. These sales were offset by orders from the wind industry and Industrial Applications. However, EBITDApre in the CF division decreased by 20.7% year-on-year to €43.2 million (previous year: €54.5 million). This earnings development is mainly attributable to the expiry of the high-margin automotive contract. In addition, a special effect from energy derivatives in the amount of minus €9.2 million impacted CF earnings in the 1st quarter of 2022. However, the implemented energy price hedges enabled the business unit to maintain its production capability throughout the entire fiscal year, that the weakening of earnings was mitigated.

The Composite Solutions (CS) business unit confirmed its upward trend in fiscal 2022 with a 25.0% increase in sales to €153.1 million (previous year: €122.5 million). The most important market segment for the CS business unit is the automotive industry. In line with the highly positive business performance, EBITDApre of CS increased by 65.3% to €20.0 million (previous year: €12.1 million). This figure also includes non-recurring positive effects of €3.7 million from compensation payments received from automotive customers for premature project terminations.

The non-operating Corporate segment contributed €17.1 million to Group sales (previous year: €16.5 million). In line with continued strict cost management as part of the transformation, EBITDApre improved slightly to minus €18.8 million (previous year: minus €19.2 million).

Outlook

"If we summarize our expectations for the 2023 financial year, it can be summed up under the guiding principle: -invest and stabilize," CFO Thomas Dippold comments on the forecast for 2023.

For the fiscal year 2023 we continue to expect solid demand for our materials and products. In particular, we expect that the demand for special graphite products for high-temperature processes, e.g. in the semiconductor, solar and LED industries, will continue to increase.On the other hand, the first-time full-year effect from the expiry of a supply contract with an automotive customer in the carbon fiber segment and the sale of our business in Gardena (USA) will burden sales development.

"The increasing demand for high-performance semiconductors for electromobility or renewable forms of energy will also boost the demand of components made of graphite for the production of these semiconductors. To benefit from the related opportunities, we will expand our production capacities in this segment and invest a double-digit million amount in 2023 . Based on existing supply relationships, we will implement this investments partly together with our customers," explains CEO Dr. Torsten Derr.

On the cost side, we expect energy and raw material prices to remain at a high level in 2023, along with significant wage increases. Our forecast implies that higher factor costs can be partially passed on to customers through price initiatives.

Based on the assumptions described, we expect Group sales to be at prior-year level and EBITDApre to be between €160 million and €180 million in the financial year 2023.

In the medium term (until 2027), we anticipate a further improvement in our EBITDApre margin between 18% and 19%.

Further details on the business development in 2022 and the forecast for 2023 can be found in SGL Carbon's Annual Report.