#Composites

SGL Carbon increases sales in the first half-year 2019

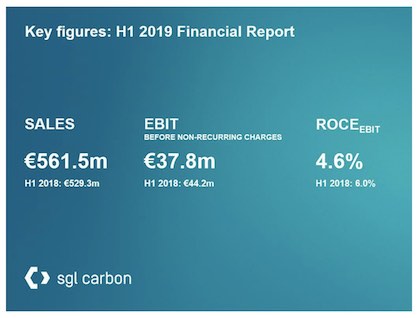

At a glance:

- Group sales increased by approximately 6 percent to 562 million euros driven by organic growth in the market segments Digitization, Energy, and Chemicals

- Group recurring EBIT at almost 38 million euros; adjusted for the positive one-time effect in the prior year, Group recurring EBIT decreased by approximately 2 million euros

- EBIT in the business unit Composites – Fibers & Materials (CFM) improved slightly in the second quarter 2019 compared to the first quarter; business unit Graphite Materials & Systems (GMS) recorded a second quarter 2019 slightly below the record result of the first quarter

- Guidance for the fiscal year 2019 confirmed

- Dr. Jürgen Köhler, CEO of SGL Carbon: “Despite a cooling global economy, demand for our solutions continued to be high, especially in the digitization, energy and chemicals markets“

- Successful placement of a 250 million euros corporate bond in April

- BMW loans which provided financing for the former joint venture SGL ACF repaid as of end of June; convertible bond 2015/2020 redeemed in July ahead of maturity

Recurring EBIT in the business unit Composites – Fibers & Materials (CFM) decreased significantly, whereas business unit Graphite Materials & Systems (GMS) substantially increased its recurring EBIT. SGL Carbon therefore confirms its guidance for the fiscal year 2019 and anticipates a mid-single-digit percentage sales increase and a group recurring EBIT on the prior year level. As previously guided, a break-even consolidated net result is expected. In this context, it should be noted that the prior fiscal year benefited from a non-cash positive non-recurring item of about 28 million euros resulting from the full consolidation of SGL ACF. In addition, for the year 2019 the company plans increased expenses in the financial result from the refinancing measures implemented lately.

“Despite a cooling global economy, demand for our solutions continued to be high, especially in the digitization, energy and chemicals markets," says Dr. Jürgen Köhler, CEO of SGL Carbon. “As expected, business unit GMS will continue to perform on the high prior year level. Following the weak performance of our CFM business unit during the first half of the year, we have initiated comprehensive measures to improve results. Overall, we confirm our guidance for the fiscal year.”

In the first quarter of 2019, sales revenue of SGL Carbon increased by 6.1 percent to 561.5 (previous year: 529.3) million euros. The increase is primarily attributable to higher deliveries and price increases in the business unit GMS. Although recurring EBIT decreased by 14.5 percent to 37.8 (previous year: 44.2) million euros, the prior-year period included an income of 3.9 million euros from a land sale. Adjusted for this effect, recurring EBIT of SGL Carbon decreased by 6 percent. The decline in earnings in the business unit CFM could not be offset by the improvements in operating earnings in the business unit GMS and in Corporate. The return on capital employed (ROCE) based on recurring EBIT was 4.6 (previous year: 6.0) percent. EBIT after non-recurring items decreased to 33.5 (previous year: 71.0) million euros, mainly due to high positive non-recurring item in the previous year. In the first half of the prior year an adjustment to the fair value of the net assets of the previously proportionally consolidated joint operation with the BMW Group (SGL ACF) was required. This resulted in a positive impact on non-recurring earnings amounting to 28.4 million euros. Because of the positive non-recurring item in the prior year and a decreased net financing result in the reporting period, the result from continuing operations before income taxes decreased significantly from 57.3 million euros to 14.8 million euros in the reporting period. Consolidated net result of the period amounted to 10.1 million (previous year: 47.3) million euros.

Composites – Fibers & Materials (CFM): Temporarily unfavorable product mix, postponement of project billings and a weak first quarter in the market segment Textile Fibers characterize first half year

Sales revenue in the business unit CFM at 219.4 million euros remained, as expected, close to the prior year level (currency adjusted: minus 3 percent). While the market segment Wind Energy recorded strong growth compared to the very weak prior year, the market segment Industrial Applications posted lower sales due to the weakening global economy. The market segment Aerospace also remained below the prior year level due to different timings of project billings. Sales in the market segments Automotive and Textile Fibers remained close to the prior year level. Recurring EBIT in the second quarter improved slightly compared to the weak first quarter, primarily reflecting the improvement in the market segment Textile Fibers. However, recurring EBIT in the first half 2019 reached 2.8 (previous year: 17.3) million euros and was substantially below the prior year level. Accordingly, the EBIT margin in the business unit decreased to 1.3 (previous year: 7.7) percent. The main reason for this development was lower earnings in the market segments Automotive and Aerospace, caused by a temporary unfavorable product mix respectively different timing of project billings. The market segment Wind Energy also recorded declining earnings due on one hand to a delivery pushback into the second half of this year based on external factors, and on the other hand to a temporary unfavorable product mix. The earnings decline in the market segment Textile Fibers is attributable to the unfavorable margin development in the first quarter, which already improved in the second quarter. The earnings improvement in the market segment Industrial Applications was not able to compensate for above developments. Return on capital employed (ROCE) based on recurring EBIT of the reporting unit CFM reached 0.9 (previous year: 5.3) percent.

Free cash flow from continuing operations again significantly improved

Cash flow from operating activities in the first half 2019 improved significantly by 23.2 million euros to 15.4 (previous year: minus 7.8) million euros. Main reason was the reduced increase in working capital. Cash flow from investing activities improved from minus 31.2 million euros to minus 24.6 million euros, mainly because the net cash payment for the acquisition of the SGL Composites company in Wackersdorf (Germany) amounting to 23.1 million euros was included in the prior year period. Capital expenditures in intangible assets and property plant and equipment increased by 53 percent to 33.6 (previous year: 21.9) million euros. Free cash flow from continuing operations improved significantly to minus 9.2 (previous year: minus 39.0) million euros.

As of June 30, 2019, total assets of SGL Carbon were at 1,784.7 million euros, an increase of 12.6 percent compared to year-end (December 31, 2018: 1,585.1 million euros) mainly due to the cash inflow from the corporate bond issued in April 2019. Equity attributable to the shareholders decreased by 4.8 percent to 506.2 million euros. The reduction is mainly attributable to the lower pension discount rate environment in Germany and the USA. Overall, the equity ratio as of June 30, 2019 decreased to 28.4 percent (December 31, 2018: 33.5 percent), not only due to the negative impacts from the pension discount rate changes but also because of the temporary increase of total assets. Adjusted for the full repayment of the convertible bond 2015/2020 and the resulting reduction in total assets in July 2019, the pro forma equity ratio as of June 30, 2019 was 31.5 percent.

In April 2019, SGL Carbon successfully placed Senior Secured Notes in the amount of 250 million euros due September 2024. SGL Carbon used the proceeds to prefund its existing convertible bond 2015/2020, to completely repay the loan by BMW related to the full acquisition of the former BMW Joint Venture SGL ACF and to pay the transaction costs related to the issuance of the convertible bond. The loan of the BMW Group was repaid at the end of June, the convertible bond was fully repurchased in July 2019.

SGL Carbon confirms its guidance for 2019

The fiscal year 2018 was impacted by positive effects from the initial adoption of IFRS 15 as well as positive non-recurring items resulting from the full consolidation of the former SGL ACF. This high comparative base influences the outlook for the current year. In addition, the company acknowledges reports on a global economic slowdown. Nevertheless, SGL Carbon continues to anticipate a mid-single digit percentage Group sales increase for 2019, which will mainly be volume driven. Group EBIT (before non-recurring items and purchase price allocation) is expected to stabilize on the prior year level, which recorded a substantial increase over 2017.

After a consolidated net profit of approximately 41 million euros in the fiscal year 2018, the company expects a break-even consolidated net result in the fiscal year 2019. It should, however, be noted, that the previous year benefited from a non-cash positive non-recurring item in the amount of 28 million euros relating to the full consolidation of SGL ACF. In addition, SGL Carbon plans increased expenses in the financial result mainly from one-time effects in conjunction with the early repayment of the convertible bond 2015/2020 and the issue of the corporate bond in April 2019 to refinance maturities due at the end of 2020. With this bond and the 175 million euros syndicated loan signed in January 2019, the company has completed its refinancing measures and is financed until 2023 with respect to existing financial liabilities.

For fiscal year 2019, SGL Carbon continues to expect capital expenditures of approximately 100 million euros after 78 million euros in the prior year. Net financial debt at year-end 2019 is anticipated to be a mid-double-digit million euro amount higher than at year end 2018 mainly due to higher capital expenditures as well as increasing interest expenses. SGL Carbon will, however, remain within its target leverage ratio, i.e. the ratio of net financial debt to EBITDA, of below 2.5. As previously announced, the target gearing level of approximately 0.5 could temporarily be exceeded due to additional capital expenditures in the years 2019 through to 2021.